83% of clients were comfortable providing a referral, yet only 29% of clients actually gave one.

That’s was what Advisor Impact found in 2010 when they surveyed more than 1,000 financial service clients to understand how customer satisfaction & loyalty was translating into new client referrals.

What’s shocking about the relatively low 29% referral rate is that 93% of the people surveyed said they were somewhat or extremely likely to continue working with their advisor & nearly 80% gave a satisfaction rating of 8/10 or higher.

Table of contents

In other words, customers were satisfied but they weren’t referring new business; why?

Partly, it’s because many of the advisors didn’t understand their own customer segments & therefore couldn’t learn more about why or when they were referring new business.

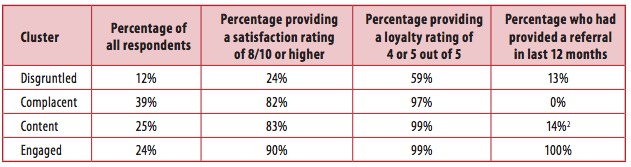

Once Advisor Impact did a cluster analysis to “help advisors better understand and model their ideal client,” it became pretty clear who sent the most referrals.

After Advisor Impact identified the different clusters, they wanted to learn what separated each group from each other, seeing that all but disgruntled customers were reporting themselves as 97-99% loyal.

Keeping in mind that we’re talking about financial advisor clients & financial planning is big part of that relationship, Advisor Impact found that 64% of “Engaged” clients say they have a written financial plan, whereas only 44% of “Content” clients reported having one, with the percentages dropping significantly between “Complacent” & “Disgruntled” customers.

It was also found that “Engaged” customers received 3-4 (or more) reviews of their portfolios and were taking part of on-going conversations where their advisor was soliciting feedback and asking for actual input.

“Content”, “Complacent” & “Disgruntled” customers each received fewer portfolio reviews and requests for feedback than the group before it. (Read the full case study here.)

Understand Your Existing Referral Analytics Before Starting A Referral Program

If I asked you what percentage of your customers came because an existing customer referred them, would you know the answer?

In an ideal world, your analytics would be configured to track the customers that are buying because existing, logged in customers are sharing links from the a product page, or somewhere within your app (click here to see how this is possible in Google Analytics).

However I’m not naive and I know the world’s not ideal. Even if you don’t have this set up in Analytics, there’s no reason you can’t set up a feedback loop into the tail end of your checkout flow that gives you an indication of how people are finding you.

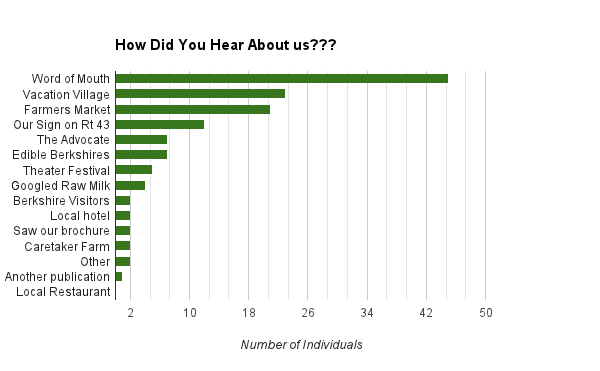

If Cricket’s Creek Farm in Williamstown, MA can do it, surely you could ask how new customers found out about you, and maybe who sent them, right?

Having this kind of data, even if it’s rough, will provide you with some insight early on as to how referral traffic from existing customers converts. Even without a referral program, referrals are occurring, and you should take steps to find out how they’re finding you. Without pre-existing data, you’ll have no baseline as to how your new “refer-a-friend” program is performing.

“Now that we have a referral program, 11% of our customers are sharing with friends!” So what? If it was 11% before you implemented the program, now you’ve wasted money on the software AND you’re losing whatever margin you’re using as the incentive for getting people to share & sign up.

Do You Know Who Is Sending The Referrals?

Understanding the conversions that come from referrals is only one half of the equation though. If you want a referral program to be successful, you need to also understand who is giving the referral.

In the Advisor Impact study, we saw that it was the “Engaged” clients who were giving satisfaction ratings of 90% and were 99% loyal that were providing the most referrals. What does that customer segment look like for you & can you find out exactly who they are?

If it means asking “Who referred you?” in a qualitative survey for new customers, then matching that against your existing customer base, so be it. Knowing exactly who is sending referrals is going to be a huge help for every other step of the process.

Why Are They Referring New Customers Completely Unprompted?

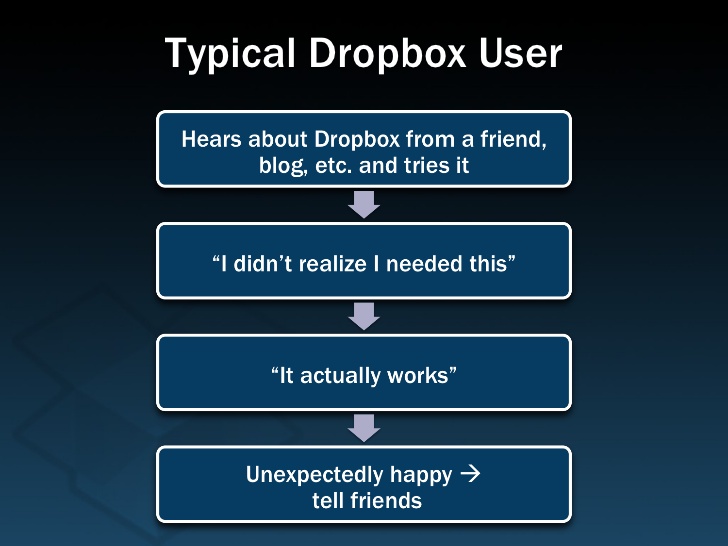

Once you know who, you need to find out why. One on one interviews, surveys, and other customer development techniques can help to reveal this. When most people talk about Dropbox’s 3,900% growth they focus on referral program being successful because Dropbox gave away free space.

What they’re missing though, was that after many unsuccessful acquisition strategies, Dropbox took a step back and found that many of their existing customers found the platform because of referrals. “Free space” was merely the trigger to get more users to share with their friends.

That’s the key to figuring out a good incentive, really. Find out what is already getting people to share, then give them the ability to get more of what they want.

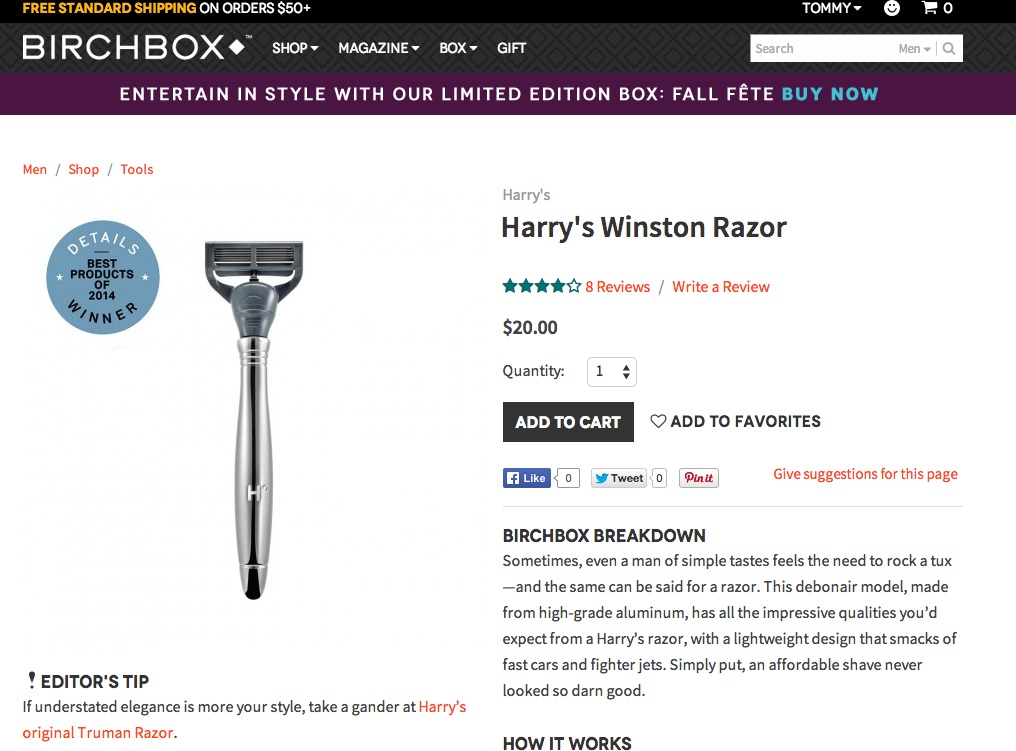

For example, Birchbox has built an entire business model around sending 4-5 monthly samples for grooming & lifestyle products you may not have known about before. If you like the samples, you can buy full sized versions in their online store. If you really liked the stuff you got, you’re probably end up telling a friend about it. Pretty neat, right?

Well that’s good, because Birtchbox’s referral program gives you 50 “points” for each friend you refer, and for every 100 points you receive, you get a $10 gift card, which can be used towards buying full sized versions of the products you’re sampling.

In this case, it’s not the “points” existing customers want, but full size products. The easiest, fastest way to get what you want? Refer your friends.

But it’s deeper than that. Human beings have been hardwired to share our experiences with our allies since we first stepped out of caves.

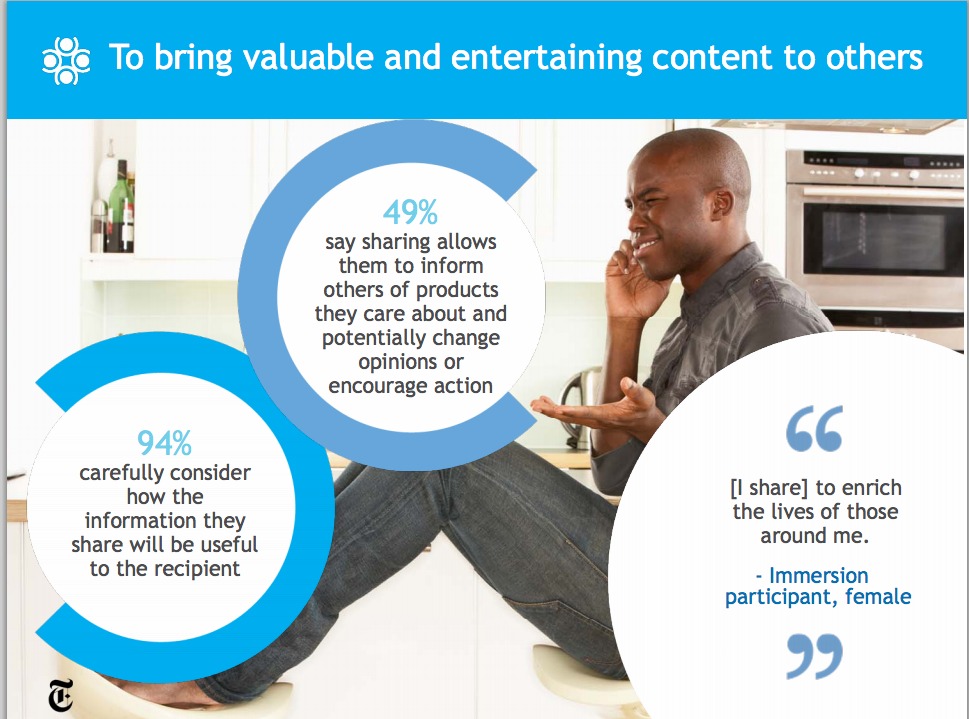

In “The Psychology of Sharing” a study by the New York Times, it was found that people share online for a core set of reasons:

- To say something about their own identity.

- Enrich the lives of those around them.

- Build social currency.

- Gain acceptance from their peers.

- Support causes they believe in.

On a meta level, it’s not about “points” or “discounts” so much as it is about sharing this really cool thing with the people you care about.

The study also found 6 distinct types of sharers, with different motivations for why they share with their networks:

- Altruists – People who are unselfishly concerned for the well-being of others.

- Careerists – Those who share to exchange ideas & improve their company’s offerings.

- Hipsters – Because being ahead of the curve gives you more social clout.

- Boomerangs – Sharing for the sake of generating feedback & starting a conversation nobody else is having.

- Connectors – Bringing groups of people together through content or deals.

- Selectives – Enjoys delivering massive value to small groups, or individuals by only referring highly relevant things.

As you develop your referral marketing program, consider your customer personas and their motivations (beyond “get free stuff”) behind spreading the word about your offer.

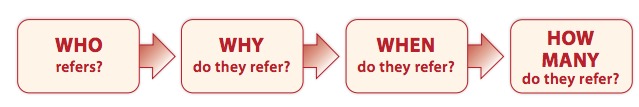

When Are They Making The Referral?

For Dropbox, the referral typically came shortly after the first run experience.

For Roku, it was 45 days after a new customer had been enjoying the service.

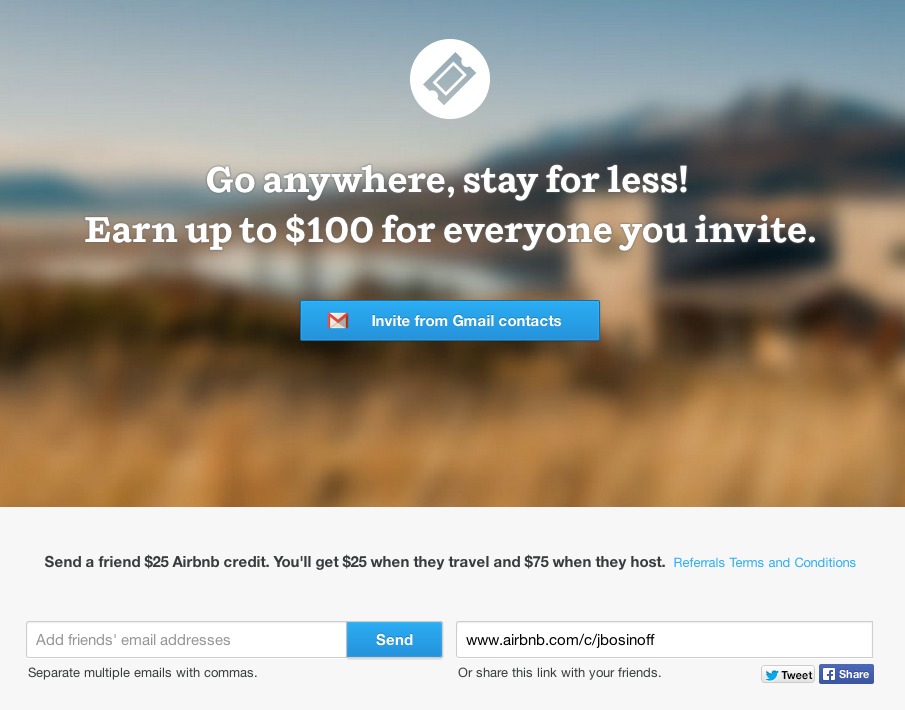

For AirBnb, it was after someone hosted or returned from a stay.

In order to time when you trigger your referral service to have the most impact, you need to understand the window of time where people are most likely to share.

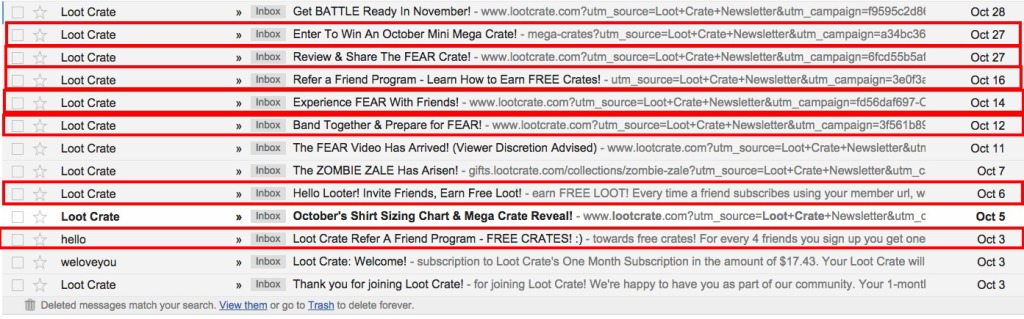

For instance, I recently signed up for LootCrate, and they told me about their referral program:

- Right after I signed up.

- 3 days after.

- 6 days later.

- 2 days after that.

- 2 days after that.

- One week after I received the package.

While that might seem like a lot, I never found it obtrusive, it actually got me more excited about the package getting delivered in the mail.

That actually seems to be the main point of this autoresponder sequence too – just to keep people engaged and build anticipation, subtly reminding them they can share with friends when the package arrives.

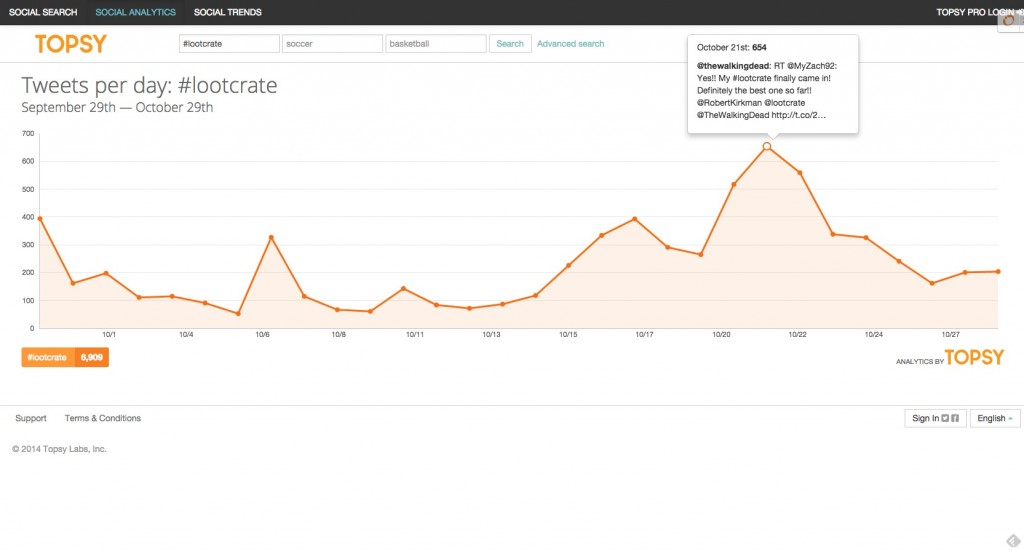

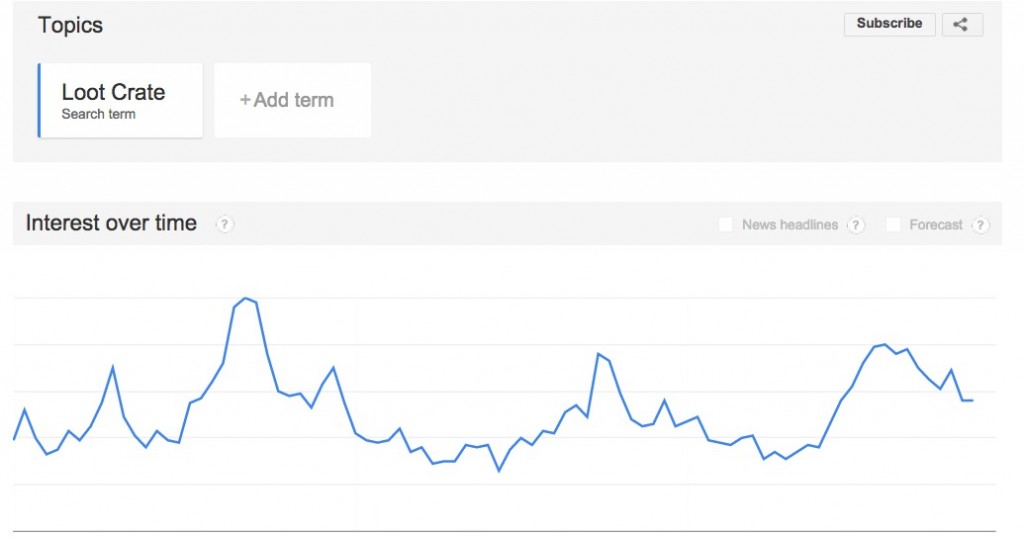

Judging by the amount of Twitter shares on Topsy, it looks like it pays off too with the largest spike in shares happening the day the crate is released.

Google Trends backs this up where most searches for “Loot Crate” the brand are happening within a day or two of when the boxes are sent out. (Are friends of existing customers doing research on their own?)

Understanding this referral lifecycle in some cases is the most important aspect to the success of the entire referral program as it allows you to put the right offer in front of the right people at the exact right time.

In another case, Hubspot’s Sidekick prompts active users (those who track more than 200 emails) to refer friends (or pay) whenever they are approaching their “Free” limit.

For the companies that don’t want to spend the $120/year/employee, this referral program is a great way to keep costs down, while also giving Hubspot an “in” to teams that could potentially benefit from their other services.

What If “When” Isn’t A Specific Time-Frame?

It’s not like I’m going to be pumped to share my financial advisor’s number within the first 30 days of becoming a client, or after they’ve sent me 4 portfolio updates, right?

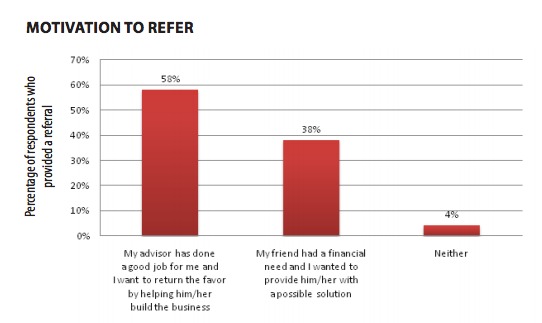

Going back to the Advisor Impact study, they found that the second biggest reason why financial advisory clients were giving references to their friends was a relevant conversation about finances came up. (Think buying a house, selling a business, saving for retirement)

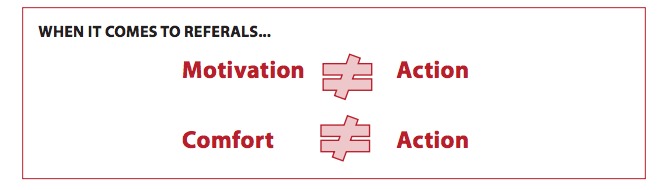

The problem was, even though 83% of clients said they’d be happy to provide a referral, only 29% were doing so, leaving a huge gap.

The reason for this gap was twofold:

- The majority of happy clients weren’t comfortable having conversations with their friends about finances.

- They didn’t know how to identify the conversations that could lead to a referral.

See, to clients it was obvious when a friend would say something like “Hey, do you know a good financial advisor?” but were completely unaware that a financial advisor could be useful for their friend of if a spouse passed on, or they wanted to aggressively save for retirement.

As part of Advisor Impact’s action plan, they suggested that financial advisors educate their clients in the broad range of services they provide, so that they can also identify the real world “conversational triggers” that could prompt the referral.

Sidenote: This is quite similar to how Loot Crate reminds you of their referral program in-between box sends, come to think of it.

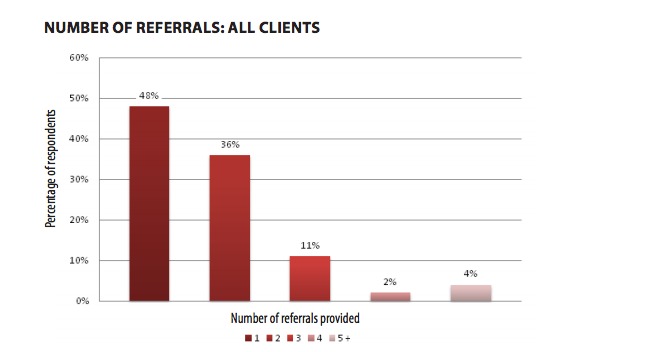

How Many People Are They Referring?

While the most accurate way of figuring this out would obviously be through a custom analytics configuration, you can get a rough idea of how many friends are being referred through a qualitative survey.

It’s important to point out, when we’re looking at the referrer side, we’re not necessarily looking at how these referrals convert (yet anyways) but rather the sheer number of referrals generated, and who is generating them.

If we know that our “Big Spender” & “Frequent Buyer” segments, for example, are also telling lots of friends, we can talk with them even more to learn about why they think their friends are (or are not) buying.

Obviously, if you are able to track the full journey of the referred customer, that’s ideal, because you have a lot more to work with, but when you’re focusing on the referrers, you’re really trying to understand what motivates them to share, who their sharing with, and what could get them to share more. because ultimately they don’t

Conclusion

Before you jump into investing in a referral marketing program, learn more about who is already sending referrals your way.

Knowing who sends referrals, why they’re sending them, when they’re most likely to send & how many people they send is going to be very powerful information to have before you fully roll out a referral program.

Next week, we’ll look at the other side of the equation, the referee, and see what it takes to get more people clicking on our referral links.

I honestly, really think it’s really cool how you got excited because of LootCrate’s referral program. It renews my conviction that referral marketing- and marketing in general, actually (I’m reminded of an Intercom blogpost here about beauty in advertising) can be something that creates great experiences for everyday folk. Awesome stuff.

I notice you mentioned the Advisor Impact statistic about how satisfied customers said they’ll refer, but actually didn’t- and then you describe how the Advisors ought to segment their customers better. I completely agree that customer segmentation is critically important, but I feel that doesn’t properly address why people don’t refer.

It’s a question that can be generalized, actually- why do people not always do what they say they would do? Three simple reasons:

1. they forgot,

2. they didn’t know who needed the referral,

3. making an explicit referral involved too many steps (no follow-through).

And all of this is clearly likely- making a successful referral conversion is a remarkably elaborate process. It usually only works when a happy advocate encounters a friend with strong purchasing intent.

Referral programs help to reduce the ‘activation energy’ for this, by

– using incentives to sweeten the deal,

– sending reminder emails to ramp up anticipation and maintain top-of-mindedness, and

– simply providing a convenient referral link for the advocate to share with his friend.

Great post, thanks for writing it! Will be sharing away. :-)

Cheers,

Visa

Hey Visa!

Thanks for chiming in. You’re absolutely right in terms of why people don’t refer & how to reduce the activation energy :-)

I really wanted the point of the article though not to look at it from a simple tactical standpoint, but rather to be more informed about who will be a part of the program, and their motivations for referring. I’ve seen a lot of referral programs fall flat on their face because they didn’t take the time to understand what their existing customers wanted, and they sent poor offers too frequently (or too little).

There are a number of additional reasons why someone might not refer too:

1. Experienced poor customer service

2. Don’t know anyone who would benefit (common for B2B)

3. Incentive isn’t worth it

If for some reason one of those other areas of business is out of wack, and the business hasn’t taken the time to investigate, the referral program won’t work, even if it’s not entirely to blame.

Great article. Right up there with the rest of your excellent posts. Very greatefulk that one of our dealers in the UK referred us to you (we are in Australia).

I would like to hear from readers and perhaps you, Tommy, what good refer-a-friend plugins or programs are available. We use InfusionSoft and WP.

Ian Hamilton