No business starts out with the goal of blending in. Yet, standing out from the competition is one of the biggest challenges entrepreneurs and marketers continue to face.

Wanting to be different from your competition is one thing, but how do you achieve it? The answer, in many cases, can be found in creating an effective differentiation strategy.

After reading this article, you’ll understand why differentiation strategy is so challenging, why so many companies struggle to differentiate because of sameness, and how to create real brand and product differentiation.

Sameness is the default for most companies today. Let’s look at why.

Table of contents

- What is a differentiation strategy?

- Why do so many companies struggle to differentiate?

- Why differentiation strategy is so challenging

- Creating real brand and product differentiation is hard.

- When differentiation strategy doesn’t matter

- The 8 best differentiation strategy examples

- Customer experience as a differentiator

- The benefits of a Blue Ocean strategy

- Category creation

- Brand

- Double down on your product differentiation

- Conclusion

What is a differentiation strategy?

A differentiation strategy is an approach to make your business unique and distinct from the rest, in order to stand out from the noise and give people a reason to choose you over others.

You’d think companies would be all about that, instead, they all too often default to a generic strategy.

This definition is closely related to competition in business, which legendary Harvard Business School professor Michael Porter defined as the struggle to attain a profitable, unique position in the market.

Why do so many companies struggle to differentiate?

The reason why so many companies lack brand and product differentiation is sameness.

Sameness is the combined effect of companies being too similar in their offers, poorly differentiated in their branding, and indistinct in their communication.

The language they use is vanilla, the product they offer like any other, and the marketing message is identical to that of their competition.

If you visit websites of competing companies, you’ll find that most offer no meaningful differentiation. They say pretty much the same things. Their differentiation strategy is lacking or completely missing.

Most state their value proposition as if they were the only company doing what they’re doing. Like sendinblue’s old landing page.

sendinblue is now Brevo, and its differentiation has improved.

It’s still focusing on growth, but now it’s differentiating Brevo as the most approachable CRM.

Why differentiation strategy is so challenging

1. You can’t compete on features (for long).

Can your differentiation be features?

A lot of companies seem to think that. They’re working on incremental improvements instead of differentiation. “We have feature X that they don’t.”

The problem is, any feature that’s meaningful and popular gets copied. You can toot your horn for a few months, but they’ll catch up. When Instagram started to feel stale, Meta just implemented Threads to utilize some of X’s (previously Twitter) most popular conversational functionality.

Even if you have some really innovative stuff, you might have a two-year runway. The differentiation has to come from places other than features. They’ll always catch up.

The result? Commoditization.

If you look at any mature category, you’ll find it full of products that are basically the same.

Take A/B testing tools. Or heat map (mouse tracking) tools. Session replay tools. Or email marketing tools. They all have similar features, with minor differences. It’s increasingly hard to say how one tool is different or better than others.

People ask me all the time: “How is this A/B testing tool different from that one?” I usually say, “They’re pretty much all the same.” I’m a category connoisseur in this case. I can explain some key differences if you really want me to, but “they’re all pretty much the same” is 98% accurate.

Commoditization is increasing in every category. Once novel features are now table stakes.

Almost all smartphones have great screens. It wasn’t always like that, but you can’t really build or sustain a competitive advantage on screens anymore. Maybe you could compete on battery life, but if you make a better battery, you can ride that wave only so long. They will catch up.

A long time ago, toothpaste manufacturers competed on only a few dimensions, like “freshens breath” and “fights cavities.” Today, consumers may expect even generic toothpastes to remove plaque, prevent gum disease, and whiten teeth.

What used to be novel is now table stakes.

2. Markets are getting only more saturated.

Never before have we had so many brands out there. The barrier of entry to starting new businesses has never been lower.

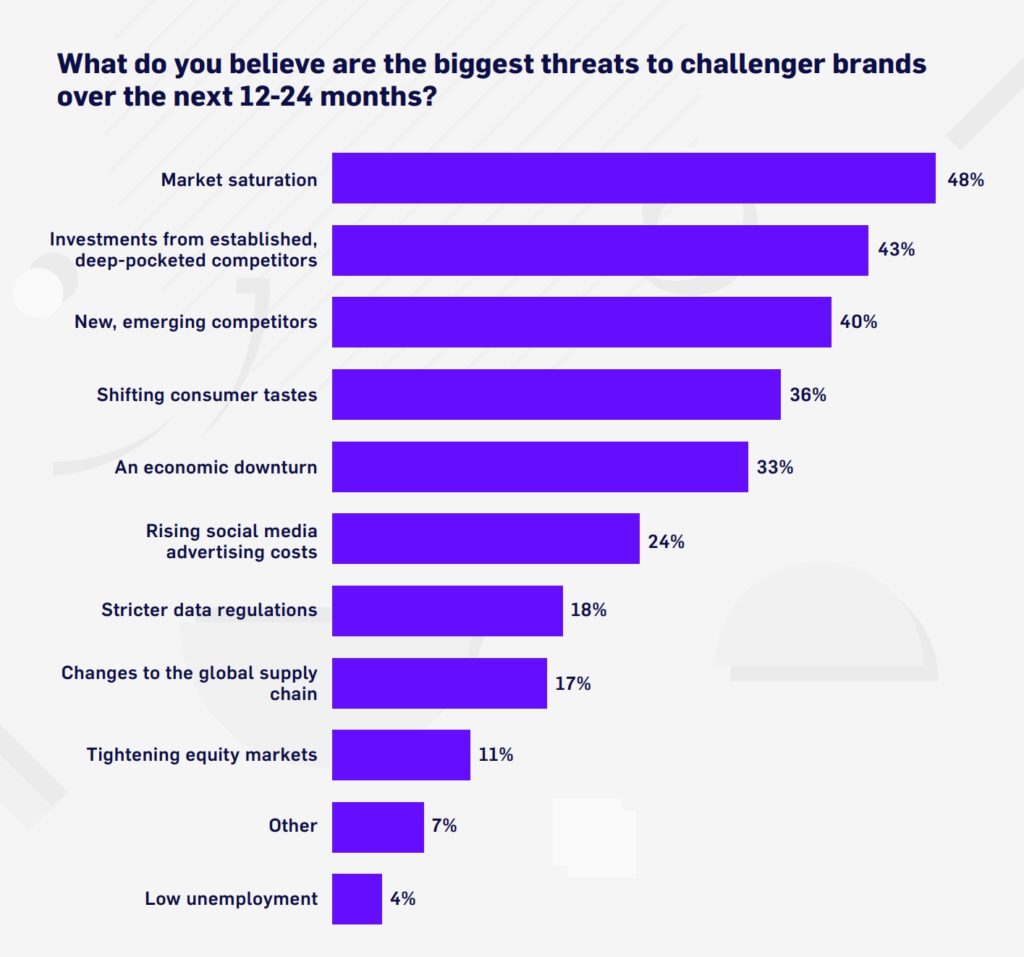

There’s the old guard and new upstarts—”challenger brands.” What do challenger brands believe is their biggest threat? Market saturation.

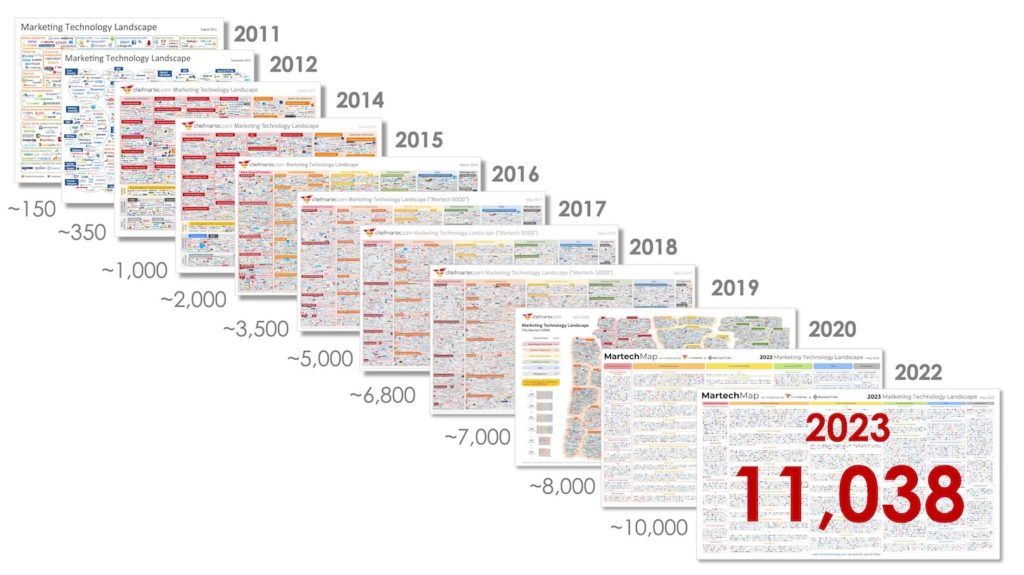

Scott Brinker maintains the marketing technology landscape project. In over a decade, it has grown more than 7,000%. There are more than 11,000 martech tools out there.

You want your me-too tool to be picked by someone? Odds are heavily against you. What stands out, gets picked.

3. Over time, competitors become more similar.

The more competition, the stronger the commitment to a strong differentiation strategy should be.

But mostly the opposite is true.

Constant comparison and benchmarking leads to conformity, and competitors become less differentiated over time.

As the number of products within a category multiplies, the differences among competitors get increasingly trivial, almost to the point of ridiculousness.

If you want to see sameness in action, just look at hotels. Almost every single hotel gives you shampoo, lotion, and some other toiletries (shower cap?!) for free, but no toothpaste or toothbrush.

How did that come to be? Because they all copy each other.

Most everything I’ve done I’ve copied from someone else.

Sam Walton, founder of Walmart

Hotels clean your room, change sheets every day. Why is this the default—at almost every single hotel? Why isn’t “choice” the default?

Because you become like your competitors over time.

You could say that people expect free shampoo, and you might be right. But meeting expectations is table stakes. You need to match it and go far beyond to avoid the sameness trap, or have a completely different take on it.

You can see the same in software. Your competitor has feature X, you need feature X. You build Y, they build Y.

If 10 startups launched tomorrow tackling the exact same space—but they couldn’t see what others were doing—what would happen? I bet we’d see some wildly different companies.

Sadly, companies focus too much on the competition and not enough on original thinking on how best to serve the user.

One of the hardest things to do is be original.

If you only read what everyone else is reading, you will likely think just what everyone else is thinking.

Haruki Murakami

Copying is easy. Being original is hard. It’s just much easier to be a copycat.

Making something that people already know they want seems like a smart idea and easy to do, which is why so many go for it.

What they’re often missing in the process is thinking about second-order effects—that they’ll end up with something just like the other stuff out there.

This is why most brand messaging is nearly identical. Instead of doing the hard work of gathering insight from customers and discovering open positions in the market, companies look at their competitors for direction. They don’t sit down and think about how to set themselves apart and develop a true differentiation strategy.

Original thought is hard, so marketers use messaging they’ve seen before. Often, they go for the obvious—stuff like “easy-to-use” email marketing. Or, in some cases, they don’t even bother to make it clear who it’s for.

Sure people want it, in principle. But if you go to market with this message, you’ll go nowhere.

Being original means doing the hard work of thinking for yourself.

Creating real brand and product differentiation is hard.

It’s not enough to be just a little bit different. The differentiation needs to be big enough to tilt the decision in your favor.

Adding words like “robust” to your email marketing software description won’t do much.

You need to be really different. And that involves risk, change, and venturing into the unknown.

Why should someone buy from you?

The easiest way to think about differentiation is to think about giving people a reason to choose you over others. That’s what a unique value proposition (or unique selling proposition, USP) should do, right?

USPs originate from the 1940s and were created for TV ads. Back then, it was easy to have a unique proposition since there weren’t that many products around. Making one-of-a-kind claims was easy. Things have changed dramatically since then.

Before the quality revolution, buying shitty products was actually a thing—lamps, TVs, and radios didn’t work or broke within weeks. This is unimaginable today. Ninety-nine percent of products—even from no-name brands—just work. We assume a certain level of quality.

Former key arguments like “cheaper,” “faster,” “stronger,” “longer-lasting,” etc., are now table stakes. We expect things to be long-lasting, support to be fast, and service to be courteous.

And if you’re going to go for a superlative—the fastest, easiest, etc.—people just won’t believe you. Extraordinary claims need extraordinary proof.

If you’re using table-stakes arguments to sell your product or pitching it like you’re the only game in town, you need to rethink your differentiation strategy.

A differentiating strategy based on price is not sustainable.

You can start with the offering the lowest price, as your competitive advantage, but often times it’s just not sustainable. If you make price the main reason to choose you, you’re playing a fool’s game—anyone can mark down a price. Somebody can and will be cheaper.

Odds are, you’ll eventually need to move upmarket as you need margins to fuel your growth and hire better people.

Walmart and Southwest have used pricing as differentiation, but they have the structural advantage to do so sustainably. Cutting prices is insanity if the competition can go as low as you can.

Small, subtle differences are not enough.

Some people are new to your category of products. Others are experts—folks who know this category intimately. Most are in the novice category.

Where a category connoisseur sees differences, a novice sees similarities. A connoisseur also knows to look for them—a novice lacks the necessary experience and filters to find or assess those minor differences.

That means that being just a little bit different is not good enough (at least not when you’re trying to increase awareness, build brand loyalty, and gain market share).

It’s scary and difficult to be different.

It’s tempting to be a safe and boring company. A safe and boring marketing strategy churns out safe and boring stuff. It’s inoffensive and, thus, beyond criticism.

You don’t stand out but also won’t get hit. Nobody will call you out. You’re just like everyone else.

The problem is, of course, that nobody will care, either. If you’re an old, established company with deep pockets, you can get away with it. If you’re an upstart looking to grow, it won’t serve you.

Sure, some people prefer to buy from boring companies, but they already have one and aren’t looking for you.

Why radical differentiation is key

When it comes to differentiation, companies don’t have an issue with being different. It’s the radically different part that’s hard.

Radically different is not a safe choice. Most deem it too risky. It’s hard to predict how it’ll play out.

Consumer research won’t tell you much about it since people in interviews prefer options that they already know and have seen. They want better and slightly improved. Innovative stuff does poorly in focus groups and user surveys.

Coming out with something new is an area where you need to rely on imagination and guts. Pay attention to the “jobs to be done,” the end goals of the user. Don’t look at the competition when it comes to how to deliver it—or you get more sameness.

When differentiation strategy doesn’t matter

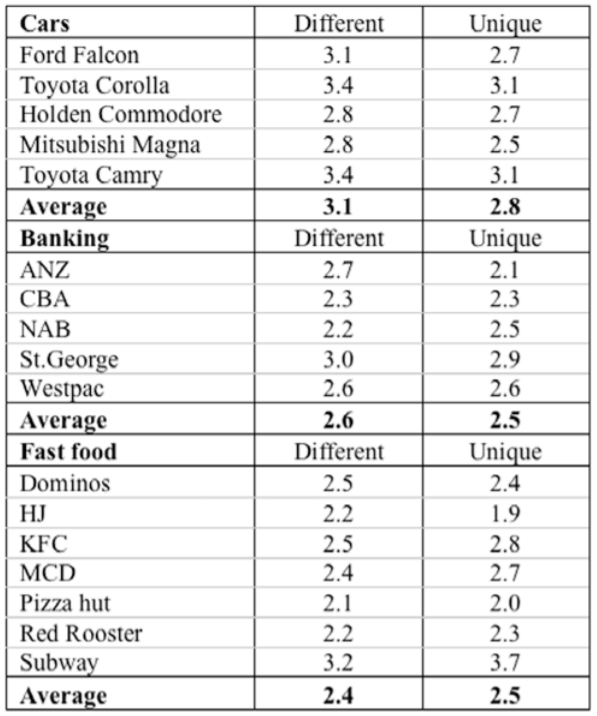

Byron Sharp and the Ehrenberg-Bass Institute have criticized differentiation, arguing that its role in the B2C setting is less important.

Some research shows that consumers can’t really see a difference among brands—they don’t even see different categories.

For example, consumers usually rate competitor companies A, B, and C similarly on attributes such as trustworthiness and efficiency, and their rapport or relevance.

Not only that, but the attributes consumers associate with particular brands tend to overlap with other brands. Ford is just as different and unique as Toyota or Mitsubishi.

Instead of differentiation, Sharp and his colleagues advocate distinctiveness, which is about increasing the visibility and recognition of a brand in its competitive environment.

Differentiation matters much less if you have a big market share.

If you’re already an established, well-known brand in a mature category, differentiation is less of an issue.

Nike vs. Adidas vs. New Balance. It’s all brand differences. Only category connoisseurs could highlight some functional differences between the shoes.

Mailchimp is number one in email marketing. It doesn’t need to be different; others need to be different from Mailchimp. The fact that people know it exists is everything.

“Familiar” often beats “differentiated.”

People have a very limited consideration set. A lot of what marketing has to accomplish is to get into the small, even tiny, consideration set of buyers.

There are hundreds of email marketing tools, yet most still consider only MailChimp plus three or four other top vendors. Mailchimp even gets recommended by people who’ve never used it—because they’re number one. People know its name.

It’s hard to get noticed.

That means that brand reach and awareness is key. However, if you’re perceived as “pretty much the same,” it’s an uphill battle. If you’re an email marketing upstart with no significant differentiation from Mailchimp, it’s extremely difficult to make it (unless you have a lot of money to spend, which probably won’t save you anyway).

You can get away with sameness in a fragmented, young category. But over time, the one with the most money (or whoever gains the most market share) will come out as the leader and position themselves as such in consumer minds. If you’re exactly like them, it’s going to hinder your growth.

It’s better to go for a particular positioning from the get-go and play to win that category. ConvertKit is “by creators, for creators” and they’ve seen great growth, rising to number one in that market.

Market share is more important than being different.

Market penetration/popularity of a brand contributes significantly toward people liking a brand and thinking it’s good.

When you ask people to recommend a tool, you inevitably hear the biggest, most popular names in the category—not necessarily ones that score best on a spreadsheet. (Most people are satisficing anyway, not doing detailed comparisons and analysis, which is way too much work.)

People often recommend tools that they’ve never used but see all the time (e.g., Salesforce, Intercom, Hubspot, Drift, Optimizely, etc).

I giggle every time I see a Twitter convo in which one freelancer recommends Optimizely to another freelancer to use on their blog for A/B testing. These guys have no clue how A/B testing works, the sample sizes you’d need, or that Optimizely runs you ~$150,000/year. But they’ve HEARD of it, so they recommend it.

Gaining market share is the best thing a brand can do for its loyalty metrics, word of mouth, and getting into a consideration set of buyers.

The more people know you exist, the more people like you. The more popular you are, the more popular you get.

Meaningful differentiation that people can easily articulate goes a long way when you still need to carve out your share of the pie.

The 8 best differentiation strategy examples

The marketing classic Differentiate or Die offers ideas for eight types of differentiation strategy (commentary provided by me):

1. Be first

Getting into the mind with a new idea or product or benefit is an enormous advantage: HubSpot and inbound marketing; Coca-Cola, “the original.”

Of course, being first is one thing; staying first is another. It takes hard work and enormous energy to stay on top with a new product or idea. Continued innovation is a must.

2. Attribute leadership

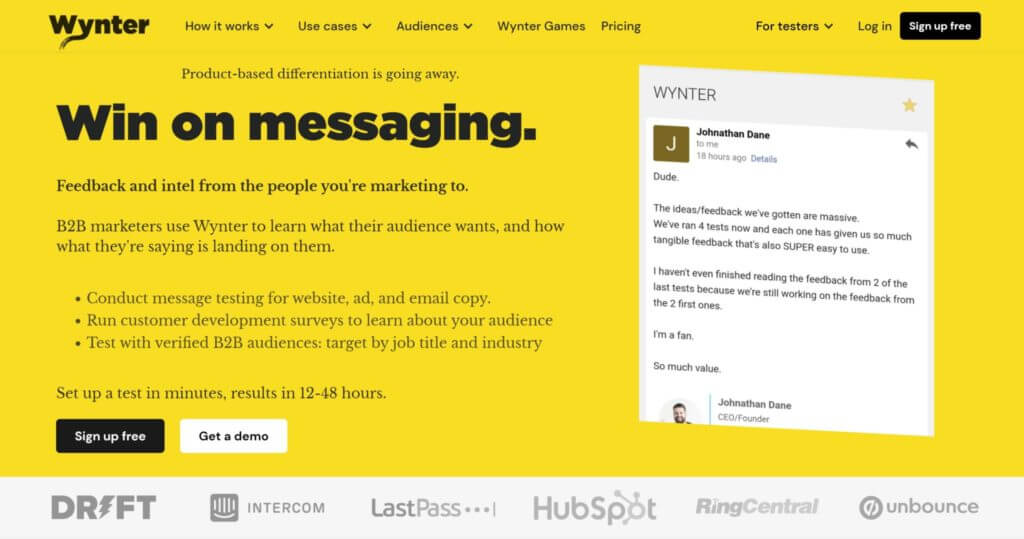

This is when you double down on a single attribute—you’re known as the best for one aspect or use case. Zappos did it with customer support. WP Engine used speed. Wynter is the only messaging research tool.

You cannot own the same attribute or position that your competitor owns; you must seek out another attribute. Don’t play the game of category leaders. Find an opposite attribute that allows you to play off the leader.

Obviously, some attributes are more important to customers than others. You must try to own the most important attribute.

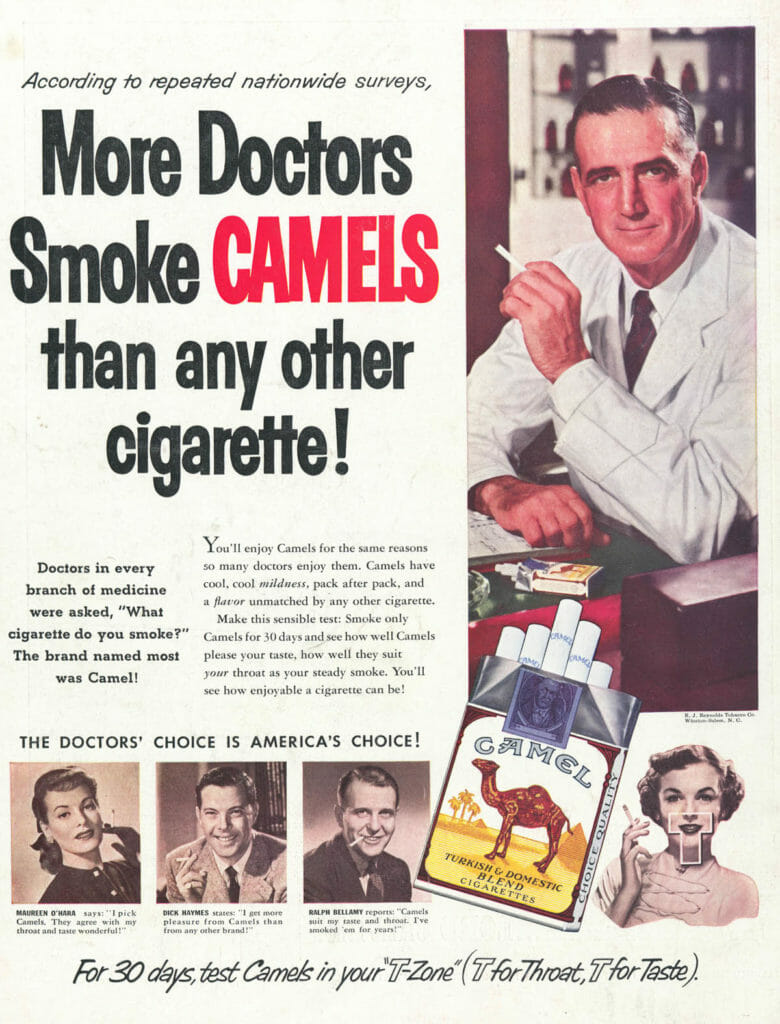

3. Be the preferred provider

This is the “more doctors smoke Camels” and “dentist-recommended toothpaste” type of differentiation. Tylenol has been doing the “#1 Doctor Recommended Brand” for decades.

Can you become the preferred tool/service of a particularly influential market segment?

4. Heritage

History has the power to differentiate your product. It can be a commanding force because there’s a natural psychological importance to having a long history, one that makes people secure in their choices.

Levi’s built America. Red Wing Shoes were the primary suppliers for the U.S. Army during both World Wars. Pizza “like your grandma made it” comes from Sicily.

5. Leadership

While people love underdogs, they usually bet on winners. Consumers love a leader. It feels safer to choose Optimizely over a smaller A/B testing tool. Optimizely is the leader, after all—there must be a reason for it!

Sometimes, people don’t know you’re the leader, so make sure they know. Maybe you’re the sales leader. Or maybe you have the highest customer satisfaction rating, or the best track record, or you’re a leader in some aspect or for a specific market segment.

Whatever the exact measure of leadership, any such claims must be specific and credible.

6. Specialize for a target market

Focusing on a single target user or use case will make you a specialist, differentiating you from the many generalists. People perceive those businesses to have more knowledge, experience, or understanding of their area, giving customers a reason to choose them.

Paperbell is not just a scheduling and billing software but scheduling software for coaches. Pilot is payroll for international employees (differentiated from Gusto or ADP).

USAA is a highly touted and specialized (military) financial services company that has $155 billion in assets, $30 billion in revenue, and $2.5 billion in profit from a consumer base of only 12.4 million.

7. Make your products in a special way

Focusing on a unique design or technology can help differentiate your product in the marketplace. This can be a secret ingredient or a branded methodology. It doesn’t matter if anyone understands it as long as it sounds impressive and credible.

Allergan’s CoolSculpting was huge for a few years. Did people really get how it worked (other than “freeze your fat off”)? No. Did it matter? No.

8. Be hot

This is about tooting your own horn. It’s the Kim Kardashian strategy: You’re popular because you’re popular.

Zoom was the hottest thing when everyone switched to working from home. It could’ve been Skype, Google Meet, GoToMeeting, or anyone. But Zoom became hot. And that led to way more hotness.

Notion is conquering the world. Roam Research has a cult. Momentum gives customers a reason to choose you.

Being hot or experiencing tremendous growth can get your product or company some altitude; once you’re there, you can figure out something else to keep you aloft.

Customer experience as a differentiator

The customer experience is how customers perceive their interactions with your company. It can be a powerful, driving force of differentiation among companies—a true differentiator.

Most companies focus on customer acquisition, not providing the best experience. They spend way more money getting the customer in the door than keeping and delighting them. Everyone calculates their CAC and LTV, but what about CKC (cost to keep a customer)?

Standing out with a better customer experience is relatively low-hanging fruit as a differentiation strategy. The bar is quite low.

If you wanna learn more about this, I highly recommend the book Never Lose a Customer Again, which lays out a fantastic framework.

The benefits of a Blue Ocean strategy

Blue ocean strategy is a famous concept that largely deals with the very same issue. It originated from a study that took place over 10 years and analyzed company successes and failures in more than 30 industries.

In their classic book, Blue Ocean Strategy, Chan Kim and Renée Mauborgne coined the terms “red ocean” and “blue ocean” to describe markets.

| Red Ocean Strategy | Blue Ocean Strategy |

|---|---|

| Compete in existing market space. | Create uncontested market space. |

| Beat the competition. | Make the competition irrelevant. |

| Exploit existing demand. | Create and capture new demand. |

| Make the value-cost trade-off. | Break the value-cost trade-off. |

| Align the whole system of a firm’s activities with its strategic choice of differentiation or low cost. | Align the whole system of a firm’s activities in pursuit of differentiation and low cost. |

“Red ocean” stands for mature markets rife with competition (red from the blood of competition), with everyone heavily commoditized. Profit margins are increasingly low. In a red ocean, companies focus on satisfying existing customers’ needs. They fight for existing customers and prioritize existing demand. In red oceans, it’s impossible to use both differentiation and a low-price strategy simultaneously.

“Blue oceans,” in contrast, are new markets—unexplored space without competition. It’s about creating a market that’s yet to be discovered by a wide audience. Over time, every blue ocean can turn into a red one as it matures, attracting more and more competitors.

A blue ocean strategy is the simultaneous pursuit of differentiation and low costs to open up a new market and create new demand. If a company can identify what consumers currently value and then rethink how to provide that value, differentiation and low cost can both be achieved. This is termed “value innovation.”

How blue ocean strategy is distinct from a differentiation strategy

Blue ocean strategy is about pursuing both differentiation and low cost, while traditional competitive strategy differentiation is achieved by providing premium value at a higher cost to the company and at a higher price for customers.

The way to beat the competition is to stop trying to beat the competition. There is no competition, but there’s also no demand—yet. (You need to create it.) You can simultaneously use differentiation and low-price strategies.

The key point is satisfying consumer needs. You focus solely on the customer—not the competition—as you’re the only one in the market.

Category creation

When Drift entered the already crowded market of live chat tools, they didn’t say, “We have this feature that makes us different.” They called the whole game something else—”conversational marketing.”

“We entered that market knowing that we had to go out, create a new category, and be the only way to conceive of it,” said Dave Gerhardt, former VP Marketing of Drift.

They changed how people should think about them. They stood out. They were different.

They did this by creating a category.

Category creation is not about being first to market with a new product or service. Sometimes this is the case, but often it’s not.

Creating a new category educates the market not only about a new solution but often about a new problem (that isn’t top of mind). Category creation sells that problem, not the product, and thus positions your innovation as the best solution to the problem.

It requires radical product/service innovation, combined with business model innovation, aided by data about future category demand. Category creators, by definition, have no direct competition—they are the market leaders. And the market leaders make the most money.

Jack Welch, the legendary CEO of GE, reviewed the company’s businesses and decided to focus on nine categories where they held one of the top two positions (or were close to achieving it).

If GE couldn’t be first or second in a category, they would get out of that business. If you can’t be the first or second in a category, your best route might be to create your own.

There are two pretty decent books on this stuff:

- Play Bigger. I hated the self-congratulating style and low-hanging examples, but the ideas are good.

- Category Creation. A mix between interesting stuff and basic marketing, but worth a read anyway.

Brand

Companies used to compete on features (i.e. who does what). At the start of mass marketing, they competed on benefits and experience.

In recent decades, it’s increasingly about brand. Functional differences get replaced by values, ideals, and identity.

Who am I if I buy your brand? What does it say about me?

- I buy Patagonia because I believe in sustainability, and I care about the earth.

- When I buy Nike, I champion women’s equality and oppose police brutality (among other things).

- I buy CXL Institute because I think of myself as a go-getter who’s going places.

- I buy jewelry from Tiffany’s—and pay a premium for that diamond—because I value the best.

Your brand is your defense against commoditization.

A strong brand is your best, most sustainable long-term marketing asset. Invest in it before you need it. It’s something your competitors can’t copy. It can be your strongest “why” for choosing you.

Functional/attribute differences matter, and innovation goes a long way, although that’s not a game that everyone can play. But pretty much anyone can compete on brand.

Soft innovation and emotional points of difference go much further in our world of endless features and benefits.

Things have finite value, but the meaning we attach to stuff—the stories we tell ourselves about it—have exponential value.

How to be different through branding

In her excellent book Different, Harvard professor Youngme Moon details three types of brands that stand out in the competitive landscape today:

- Reverse brands;

- Breakaway brands;

- Hostile brands.

1. Reverse brands

Most brands continually improve their value proposition because they assume customers can never be fully satisfied. However, Reverse positioners assume that although customers do want something more than the baseline product, they don’t necessarily want more features.

So, reverse brands remove certain aspects from a product that customers might expect and add in new, unexpected things. Case in point: IKEA.

While classic furniture stores are full of salespeople and furniture that lasts a lifetime, IKEA provides no in-store assistance, and the furniture might not last very long. While classic furniture outlets do home delivery, IKEA shoppers must build their own furniture from parts.

But you get great design at affordable prices. Its stores have an airy, ultramodern look. There’s a restaurant offering Swedish meatballs and other delights.

It works. While U.S. furniture stores have steadily lost out to retailers like Walmart, IKEA has become the largest furniture store in the world (and second largest in the United States).

And nobody has been able to copy IKEA.

2. Breakaway brands

Breakaway brands recognize that product categorization is arbitrary. We wouldn’t eat cookies for breakfast, but lots of people eat sugary cereal with the same nutritional value because “it’s cereal.”

Diaper manufacturers had a problem. Most parents were embarrassed to buy diapers after their baby turned three, so parents potty trained them well. Then they invented Pull-Ups, diapers that look like underwear. The use case was for 3–5 year olds. Social stigma was gone, and profits soared.

That’s what a breakaway brand does—you take an existing category and redefine its use case. Cirque du Soleil did this when they reframed the circus, exchanging animals for amazing acrobatic and physical feats by humans.

3. Hostile brands

Hostile brands play hard to get. The antithesis of “feel-good brands,” hostile brands defiantly demand a decision—love me or leave me. They’re intentionally polarizing.

Hostile brands are unapologetic about aspects that some might consider shortcomings, even flaunting their flaws. When Mini Cooper launched in the United States, the brand made no apologies for being a small vehicle in an SUV-loving country. They boasted that the vehicle was tiny, an anti-SUV.

Hostile brands may make us uncomfortable (like some clothing brands being made exclusively for skinny people), but in the end, their polarizing nature makes them stand out in the sea of sameness.

Traits of successful commodity brands

In his book Bigger Than This, Fabian Geyrhalter discusses eight “brand traits” of successful commodity brands.

1. Story

This is the best way to stand out with a commodity brand when you don’t have any innovation—have a story. Fishpeople Seafood is a B Corp that tells the story of meticulous standards for sustainability and accountability. They focus on their founder stories, but, most importantly, you can trace the fish you’re about to eat and get the story behind it.

2. Belief

This is about shared values—where a brand connects deeply with its tribe through a shared belief, achieved by understanding its members. This takes a lot of monitoring, listening, and, most of all, conversing in an open, casual manner on social media, at events, etc. Passionate beliefs become the driving force of your business. Black Rifle Coffee Company is a pro-gun company that gained national attention in 2017 for supporting Donald Trump. They live their values, and thus attract (and repel) certain groups of people.

3. Cause

Aligning your brand’s existence with a cause can give you a strong brand positioning. Your business exists to right a wrong, to do some good in the world. TOMS shoes comes to mind.

4. Heritage

Connect your product with consumers’ desire to form a deeper connection with a place, real or imaginary, or even a time in history. Nostalgia in branding has always worked, even back in the day. It’s why Coca-Cola shows us the old Santa Claus year after year. They pulled it off, but heritage can be hard to scale.

5. Delight

This is similar to the customer experience focus discussed previously. Small, unexpected gestures lead a consumer to see you as a friend. When you repeat this step and way of thinking, you move from friendship to community creation. Aim to create a brand vibe no one can steal.

6. Transparency

Leading your brand with transparency gains immediate trust with your consumers. I instantly think about Buffer and their transparent salaries. Moz and ConvertKit have also been very transparent. Transparency and honesty takes a serious commitment. What if you ran a radically transparent company? Live-streamed internal meetings? Made strategy documents and the like public? Nobody is that brave. But you’d have no competition, that’s for sure.

7. Solidarity

Solidarity is the idea of aligning your brand with someone else’s dream. It requires you to show deep empathy for a very specific audience and align your offering, your story, and beliefs and messaging with your followers’ point of view. You need to exemplify the values of your tribe in everything you do and say.

8. Individuality

Personalized products and experiences. A unique story and customized product wins consumer attention through individuality. Surprise your tribe by being personal, thus making your brand personable. Wonderbly made a splash with their Lost My Name books.

Personal brands

Another way to give people a reason to choose you over others is through personal branding. If prospects like the people associated with your company, they’re more likely to buy from you.

Tesla has Elon Musk. If I like and respect Elon, I’m more likely to buy a Tesla. Who’s the name behind Chevrolet or Mazda? No clue.

Microsoft had Bill Gates. Apple had Steve Jobs. Huge companies still use personal brands. Google. Virgin. HubSpot. Salesforce. It’s just so much easier to relate to another human rather than an entity.

I like Rand Fishkin and enjoyed his Whiteboard Fridays, so I’m more likely to sign up for Moz (even though he’s no longer with the company) than SEMrush. I’ll give Sparktoro a spin because I like Rand.

You don’t need to be the founder or CEO to use a personal brand for differentiation. Look at what Dave Gerhardt did with Drift when he was the VP of Marketing there. Now he’s at Privy, and while most folks have no idea what Privy is, they already have a favorable gut feeling about it because of Dave’s personal brand.

As Basecamp’s founders wrote in Rework, pouring yourself into your product is a powerful way to stand out from the crowd:

If you’re successful, people will try to copy what you do. But there’s a great way to protect yourself from copycats:

Make you part of your product or service. Inject what’s unique about the way you think into what you sell. Pour yourself into your product and everything around your product too: how you sell it, how you support it, how you explain it, and how you deliver it.

Competitors can never copy the you in your product.

One-hundred percent. And because I might be a fan of the outspoken founders of Basecamp, I will choose Basecamp over other project management software (or at least include it in my consideration set).

Double down on your product differentiation

Identified your key differentiator? Now double down on it to create your differentiation strategy. Optimize your machine to deliver on that promise.

- Are you faster? How about you make it 10x faster.

- Cheaper? Go way cheaper—make it all about cheaper. (This works only if the competition can’t match that due to your unit economics or a structural advantage.)

- Better quality? Make that quality advantage 10x better than anything else out there (as long as it’s specific).

- Better customer experience? Go for the 11-star experience.

That way, your differentiator will become truly that.

Conclusion

Marketing is a game of attention. If you do what everyone else is doing, it’s hard to get it.

If your goal is to gain market share and awareness but you have no clear product differentiation, that’s a problem. Unfortunately, it’s not a problem that’s easy to solve.

Differentiation requires all-in commitment. It can’t be delegated to low-ranking marketers. It’s not a tactic somebody can ship. It’s not a line of copy one writes.

Differentiation strategy needs to be driven by the C-Suite. The CEO needs to own it. It’s a strategic decision—one that may determine your company’s long-term success.

Working on something related to this? Post a comment in the CXL community!

We are offering Enterprise Retail management on Cloud that supports the entire Retail Business. Get all traditional and Digital Commerce related services under one roof.

I just love the stuff you roll out. True gold and getting into my bookmarks for future reads. Peep, I think majority of the companies end up same on value prop in order to accommodate keywords for SEO.

Take the Freshworks example, I am assuming they are targeting the keywords ‘Email Marketing Software and ‘Email Campaigns’. While I know that we should write for humans and not for crawlers, still would like to know your thoughts.

Ready to take a hit on SEO for the sake of differentiation?

Interesting read and getting into my bookmarks for future reference.