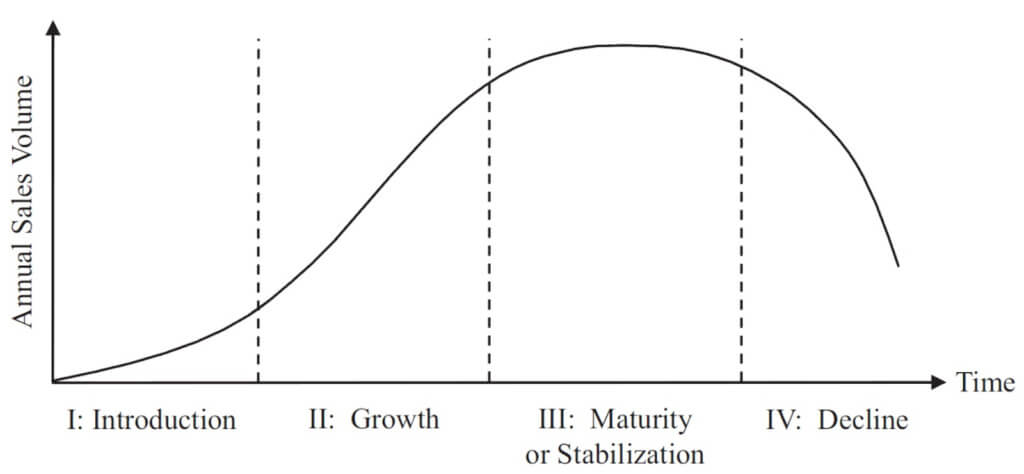

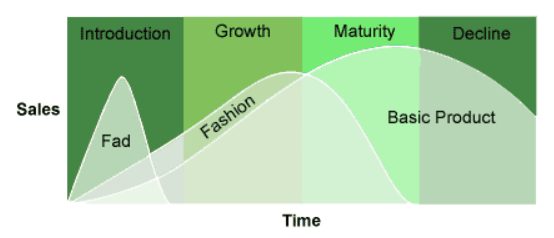

The classic graph for the product lifecycle is a sales curve that progresses through stages:

- a sharp rise from the x-axis as a product transitions from Introduction to the Growth phase;

- a sustained, rounded peak in Maturity;

- and a gradual Decline that portends its withdrawal from the market.

Each stage of the product lifecycle has implications for marketing. But an MBA-friendly curve rarely translates to reality. The goal of product lifecycle marketing is not to match the curve but to outline what may work best now and plan for the future.

Skilled product marketers shape the curve: speeding through the Introduction, increasing the slope of the Growth phase, extending the length of Maturity, and easing the pace of the Decline. (Wanna learn more about product marketing? Take the Product Marketing Certification Training Program).

Table of contents

What is product lifecycle marketing?

Product lifecycle marketing aligns marketing efforts with a product’s lifecycle stage. Product lifecycle management includes all activities related to the product lifecycle, not just marketing. There are four stages:

- Introduction

- Growth

- Maturity

- Decline

Some iterations of the product lifecycle tweak names or add additional stages. The purpose of the product lifecycle illustration is not to debate semantics but, in a single view, to understand how product sales typically change over time. Your product lifecycle will not match it, nor should it.

Indeed, as Theodore Levitt noted decades ago, many products never make it beyond the first phase:

[M]ost new products don’t have any sort of classical life cycle curve at all. They have instead from the very outset an infinitely descending curve. The product not only doesn’t get off the ground; it goes quickly under ground—six feet under.

The benefits of looking at marketing through the lens of the product lifecycle are multifold:

- Provides a broad understanding of how your product fits into lifecycles for the product class, form, or brand (e.g. petrol-engined cars, people-carrier, and Ford, respectively).

- Identifies which stage you’re in to help you understand what you need to communicate and how to do so persuasively.

- Spots the early signs of a pending transition to a new stage and suggests how your marketing campaigns should accommodate that change.

Of course, none of that matters if you can’t push your product past the Introduction phase.

1. Introduction

The Introduction stage is when the product first comes to market. It may include or—for those who want a more granular division of lifecycle stages—be preceded by a Development stage.

How to identify if you’re in the Introduction stage

If your product hasn’t yet launched, it’s obvious that you’re in this initial phase of the product lifecycle.

For recently launched products, marketers in the Introduction stage focus on creating awareness and motivating potential buyers to consider a product—to be in the conversation when potential buyers consider their options.

What marketing needs to accomplish during the Introduction

- Create product awareness and trial

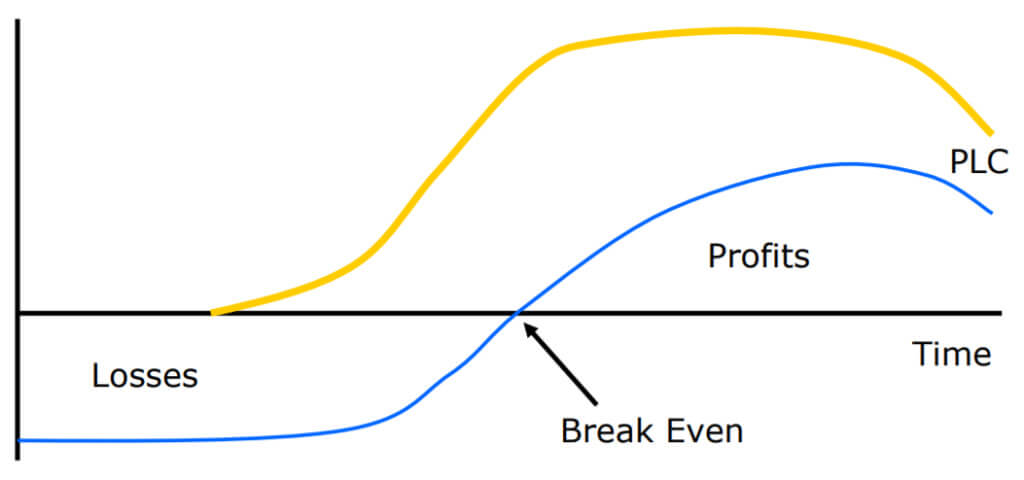

The introductory stage is rarely profitable:

profits are negative or low because of the low sales and high distribution and promotion expenses [

. . .] Promotion spending is relatively high to inform consumers of the new product and get them to try it. Because the market is not generally ready for product refinements at this stage, the company andits few competitors produce basic versions of the product.

Unlike successive stages, there’s no benefit to prolonging the Introduction phase. As a result, the primary marketing goal is to roll out campaigns that move quickly past Introduction to Growth: To build enough awareness that consumers know of the solution (if it’s a new market) or know of your company when considering the solution (if it’s an established market).

Research needs

Without a wealth of post-purchase consumer feedback, marketers in the Introduction stage may rely on user research conducted by others in the company, like the product management team. This may include data from test marketing or initial market research.

Questions marketers need to answer include:

- Why did they create this product?

- What problem does it solve?

- How big is the market?

- Who are the intended purchasers?

- Which potential users or companies are influential in this space?

The answers help define which marketing messages and channels will be most influential.

As Lucas Weber notes in his product marketing course, it’s also essential to get marketing and sales teams’ buy-in for the product before they begin working on campaigns. Teams need to believe in what they’re selling before they can pitch it persuasively.

Questions marketing needs to answer

What is your go-to-market strategy? A go-to-market strategy identifies how the company plans to move through the Introduction stage and catalyze Growth. There are three main options, with hybrid options also possible:

- Sales led. Customer acquisition costs can be high, and growth may require large sales teams. In the Introduction period, a sales-led strategy may work if the goal is to gain adoption by a small number of influential users or companies.

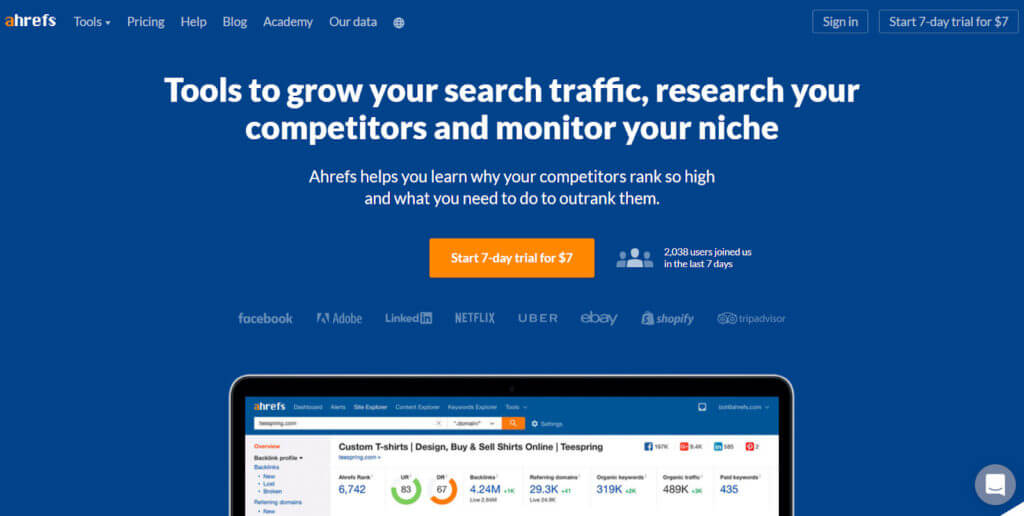

- Marketing led. Marketing-led strategies often scale more efficiently than sales-led strategies, but rising PPC costs—especially in established markets—can price-out startups in some channels. A marketing-led strategy requires strong communication and data-sharing between marketing and sales teams—true demand generation.

- Product led. For SaaS companies, product-led strategies have the potential to bypass the shortcomings of the other two. Free-trial or freemium offerings can scale awareness while limiting marketing outlays.

For marketers, the go-to-market strategy helps determine the primary call to action: A sales-led strategy may be a demo request, whereas a marketing-led strategy may focus on email signups, and a product-led strategy asks prospects to start a free trial.

How long is the expected product lifecycle? Not every company is preparing for a full product lifecycle. VC-backed companies that focus on user adoption—at the expense of profitability or even revenue—may never plan for phases beyond Introduction and Growth.

The latter phases become someone else’s problem, as they did with WhatsApp. The company focused on driving user adoption, and Facebook bought the company in 2014 without knowing how to monetize users. Zuckerberg felt that any platform with a half-billion users had potential, even if that required a $19 billion bet. (By 2018, WhatsApp had 1.5 billion users—but still no monetization.)

Additionally, products that require more market development may linger longer in the Introduction phase:

A proved cancer cure would require virtually no market development; it would get immediate massive support. An alleged superior substitute for the lost-wax process of sculpture casting would take lots longer.

Other products that qualify as fads or fashions expect shorter lifecycles—and sharper slopes between each phase:

How should you price your product? Products in the Introduction phase operate along the spectrum between two ends of a pricing strategy. Each has strong implications for the target audience and which go-to-market strategy may be most effective:

- Skim the cream. Seek out the early adopters who are price insensitive. The strategy is to recoup product investment costs quickly at the expense of larger but more gradual profits in years later. A high price point also invites competition, unless a product enjoys patent protection.

- Rapid market penetration. A lower price point may increase adoption and keep competition at bay for longer, but also takes longer to achieve profitability. Low pricing has other risks, and faster market penetration isn’t always better:

“Some products that are priced too low at the outset [. . .] may catch on so quickly that they become short-lived fads. A slower rate of consumer acceptance might often extend their life cycles and raise the total profits they yield. The speed of market penetration depends on the availability of marketing resources—a higher potential speed should increase the rate of adoption.

Signs you’re headed to the Growth stage

When marketing conversations focus more on competitors—rather than creating a market or earning consideration among potential buyers—you’re headed toward the Growth phase of product lifecycle marketing.

Another sign: You’ve moved past the initial product launch and must consider how to promote product updates to an existing consumer base or use them as a means to acquire new buyers.

2. Growth

The Growth stage is the period with the sharpest increase in sales. It includes a significant boost in market presence, the addition of new product features, and a greater emphasis on positioning relative to the competition.

How to identify if you’re in the Growth stage

Levitt explains one way to determine if your company is in the Growth period: “Instead of seeking ways of getting consumers to try the product, the originator now faces the more compelling problem of getting them to prefer his brand.”

If you’re in an emerging market, you may lure new competitors into the field. If you’re in an established market, you may go head-to-head with industry stalwarts more often.

Importantly, Levitt goes on to note, competitors shape marketing campaigns during the Growth stage:

The presence of competitors both dictates and limits what can easily be tried—such as, for example, testing what is the best price level or the best channel of distribution.

There is one benefit of increased competition: Your competitors’ campaigns may help increase overall demand for your product class, which allows marketing teams to shift resources back toward promoting your product.

What marketing needs to accomplish during the Growth stage

- Maximize market share

During the Growth period, the marketing team works to widen their audience and build brand preference.

Research needs

What have you learned about your consumers? By the Growth stage, you should have enough consumer data to begin building marketing strategies based on consumer experiences with your product, rather than consumer attitudes or behaviors related to the problem your product solves or competitor offerings.

Qualitative user research has many sources:

- Buyer intelligence and message testing

- User/usability testing

- Live chat transcripts

- One-on-one customer interviews

- On-site surveys

That research, in turn, affects marketing plans:

- Creation of user personas

- Development of marketing copy

- Ability to make data-driven UX decisions

- Prioritization of meaningful product updates

How does your company and product compare to competitors? Also during the Growth phase, you’ll dive deeper into competitor analyses to determine how your value proposition compares and which aspects of your product or brand will help differentiate.

Questions marketing needs to answer

How are you positioning your product? If your current product is more advanced than competitors, you may be best positioned to earn a dominant market share—which means pushing more resources into current campaigns (at the expense of near-term profits).

If you’re product development lags behind, you may have more success competing on value, or by developing a brand—even a brand-owned term—that makes an emotional appeal to consumers.

How will you pitch new product features? To deploy the right marketing strategy, you need to know the rate of product development—how (and how often) the product team rolls out updates. Big updates usually require a big marketing push. If your product team pushes big releases infrequently, marketing teams need to plan in advance:

- Is a product update big enough to justify its own ad campaign? Will you need a dedicated budget, content, or landing pages?

- Is the update best suited to attract new customers or retain existing ones?

- Does a particular update target a subset (or new cohort) of your target audience? Do you need to source tailored quotes or case studies to make a persuasive case to that audience?

In contrast, for smaller updates, marketing may focus on in-product messaging. In SaaS platforms—especially product-led ones—that often includes tooltips, notifications, or tutorials that appear within the product’s UI.

Does the sales staff have what it needs? Many companies in the Growth stage are adding sales staff to reach new markets or increase penetration in existing ones.

Marketing is often in the middle: learning about product development from product managers and translating that knowledge into persuasive collateral for sales teams.

Signs you’re headed to the Maturity stage

Growth transitions to Maturity as the rise in sales (not profits) levels out. By the end of the Growth stage, most people who want your product have it (or a competitors’), and the focus shifts toward winning customers from competitors and making marketing more efficient.

3. Maturity

The Maturity phase represents the height of a product’s adoption and profitability. The height of the apex depends on past achievements during the Growth period; the length of the Maturity phase depends on how long marketing can sustain the product’s dominant market position.

How to identify if you’re in the Maturity stage

“The first sign of its advent,” Levitt argues, “is evidence of market saturation. This means that most consumer companies or households that are sales prospects will be owning or using the product.”

In practical terms, it means that most “new” customers are not new to your product class but, perhaps, new to your brand—they’ve switched from a competitor. Conversely, many of your losses are wins for your competitors.

What marketing needs to accomplish during the Maturity stage

- Maximize profit while defending market share

Levers that worked during the Introduction and Growth periods have a lesser impact during the Maturity phase. More competitors and an established market likely mean that differentiation in product features declines, and you may have competitors at both ends of the spectrum—those who offer the product more cheaply and those who offer a higher-end version.

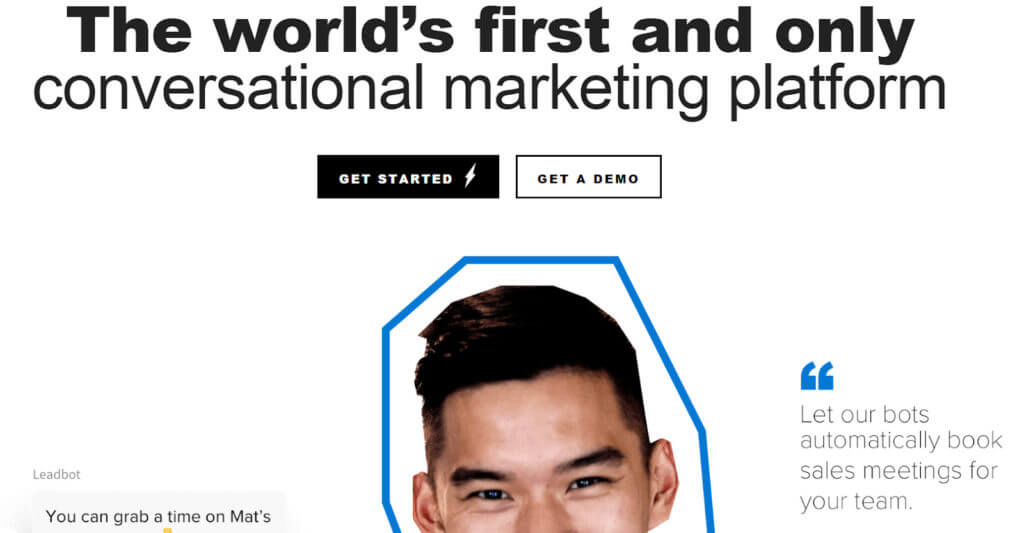

One lever doesn’t weaken the brand. Companies like Drift have risen to the top of a crowded market, in part, because of a strong brand identity—in this case, one centered on “conversational marketing.” For other organizations, like HubSpot, which owns “inbound marketing,” the brand has helped maintain their status as a market leader.

In short, as differentiation based on product features becomes more difficult, brand becomes a powerful and stable differentiator—essential for companies that seek a long Maturity period.

Research needs

What does market and consumer research suggest? In a mature market, the key to extending the (profitable) lifespan of a product is to understand the catalysts that lead to Decline.

Market and consumer research, which, in a mature market, may be conducted by third parties like Gartner or Forrester, can help suggest where the market is headed. That research may include which demographics are likely to drop off first (or stay the longest), helping to steer marketing campaigns toward higher-value consumers.

What is the sales staff learning? A mature product is more likely to have a large sales staff with deep consumer knowledge. (The research methods outlined in the Growth phase are still valuable.) Their learnings can help you understand which aspects of your product are stickiest or which decision points consumers use to choose your product or a competitors’.

Questions marketing needs to answer

How are you building or sustaining the brand? While early phases may focus on differentiation via product features (or, if you were the only company, not differentiating at all), the Maturity phase rewards companies that can differentiate their product on brand.

Part of that effort, Weber details, comes down to the balance between persuasive vs. descriptive marketing. A greater focus on brand will also yield a greater focus on persuasive marketing—campaigns that make an emotional rather than rational appeal to consumers.

What is your most profitable demographic? Prolonging the Maturity period also requires an increase in marketing efficiency—greater efficiency sustains or grows the profitability of a product, even as

Efficiency could come from shifting marketing resources toward the most valuable demographic, or via promotion of the most profitable versions of a product (e.g. basic vs. enterprise-level packages).

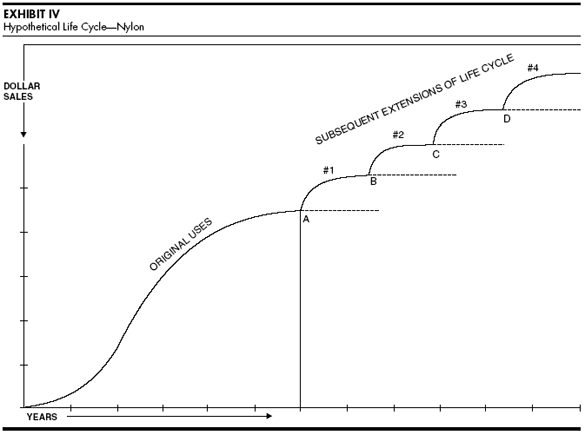

How can you prolong the Maturity phase? Marketers can extend the Maturity period in several ways:

- Identifying new demographics for the product. Is there a subset of potential users that, if marketing reframed its messaging, could become viable prospects?

- Identifying new uses for the product. Bubble wrap, the slinky, Coca-Cola—the list of products known for their secondary uses is long. You probably won’t discover an alternative for your product that generates decades of exponential growth, but you may find a way to prolong the Maturity phase for a year.

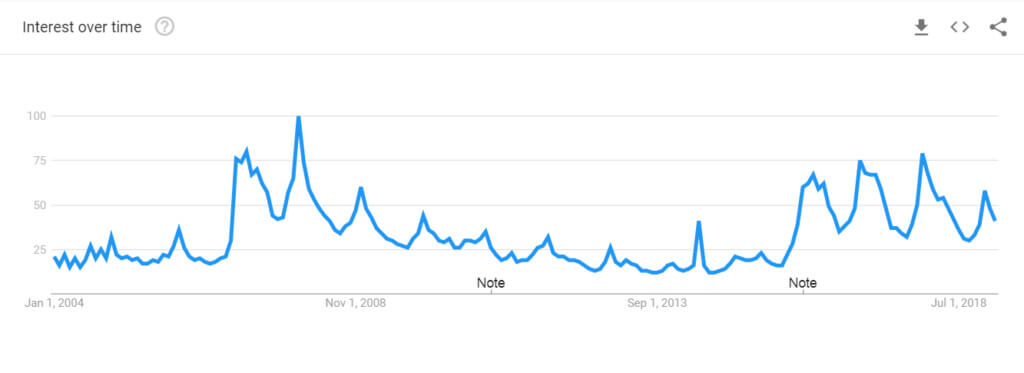

- Hope a new style or fad comes to the rescue. The Rubik’s Cube seems good for a once-a-decade revival:

Signs you’re headed to the Decline stage

Levitt identifies the symptoms of a product transitioning from Maturity to Decline:

Production gets concentrated into fewer hands. Prices and margins get depressed. Consumers get bored. The only cases where there is any relief from this boredom and gradual euthanasia are where styling and fashion play some constantly revivifying role.

A move to the Decline phase, however, doesn’t justify marketing complacency.

4. Decline

The decline phase begins as product sales and profits shrink. Still, an effective marketing effort can make a decline more gradual, earning additional sales from “laggards” and giving a company more time to pivot to its next effort.

How to identify if you’re in the Decline stage

Is the market consolidating into a few major players? Are margins shrinking? Is the product viewed as a commodity? All are signs that you’ve reached the Decline phase in your product’s lifecycle.

What marketing needs to accomplish during the Decline stage

- Reduce spending and milk the brand

Research needs

Who are the laggards? Identify the late-adopters among your buyers (or potential buyers). The addition of a new demographic or expansion an existing one can slow the downturn in sales.

What are the most expensive marketing channels? A historical review of the most expensive marketing channels—the efforts with the highest customer acquisition costs—aids planning for pending cutbacks to product promotion.

Questions marketing needs to answer

How can you milk the brand?

An effort to milk the brand spends brand capital to generate near-term profits. Apple knows that iPhone sales are in decline, which is why they announced in 2018 that they would no longer report unit sales. They continue to report unit profits.

Apple is “milking the brand”—charging customers more because they can—and easing the impact of a reduction in iPhone sales, due in part to market saturation:

How can you reduce marketing spend? The most proactive marketing effort in the Decline phase is to reduce marketing spend. A reduced spend aligns marketing investment with a product’s reduced sales and profitability. A failure to reduce marketing spend risks sharpening the slope of the Decline.

When will the company harvest or withdraw the product? Harvesting the product ekes out the last bits of profitability. Harvesting reduces or eliminates investments in product development and promotion to lower costs.

If you don’t know when the company plans to withdraw a product entirely, you could waste valuable resources on a marketing campaign that will get cut short before it can return sales—spending thousands on the acquisition of leads who may never get the drip campaign or follow-up call they need to become clients.

Conclusion

Levitt suggests that “the best way of seeing one’s current stage is to try to foresee the next stage and work backwards”:

- If you’re just starting out, how will your value proposition and go-to-market strategy operate in a crowded marketplace, or when you’re product offering is competitive with industry leaders?

- If you’re in your Growth phase, are you differentiating on more than just features? Are you building a brand that can be a dominant force with a long Maturity period?

- If you’re coasting in Maturity, what can you do to stave off Decline? Which market changes are likely to erode profitability in your product? Can you build efficiency into your demand generation campaigns to extend profitability?

Contrived as it may be, the product lifecycle forces a proactive approach: You know generally what’s coming next, the research you need to make data-driven decisions, and the questions you must answer to execute timely and profitable marketing campaigns.

Working on something related to this? Post a comment in the CXL community!

This is a great post, Derek. You covered a lot, and give us steps to take in each stage. This is very in depth, and definitely worth a bookmark for any marketer. It is helpful to see all of it listed out, we don’t often think of all the phases when focusing on one thing at the moment.

Richard, thanks! I’m glad it’s helpful for you. Onward!