Upselling and cross-selling are two ways to do the same thing: grow your revenue by getting customers to spend more.

It’s a mutually beneficial deal where customers get a better experience, and you get a fatter bottom line.

But many businesses jump in too early, neglecting their buyer’s intent, choosing the wrong method, and annoying customers instead of enhancing their experience.

In this article, you’ll discover what everyone’s missing about cross-selling and upselling, so you can apply today’s best practices to delight customers, deliver more value, and drive revenue growth. We’ve also written about upselling and cross-selling examples in another article.

Table of contents

Here is what everyone’s missing about cross-selling and upselling

Cross-selling and upselling are similar, but not synonymous.

Cross-selling involves additional product recommendations: “If you like this, you might also like this.”

Upselling is about upgrading the customer’s original purchase: “That’s a good choice, but this one is better, and here’s why.”

Both cross-selling and upselling can take place during the initial sale, or further down the track, once the customer relationship has been established.

Used effectively, the two techniques can maximize customer value and improve key revenue metrics like LTV (customer lifetime value) and AOV (average order value).

Maximizing value: What is cross-selling?

Cross-selling occurs when you recommend additional products or services on top of what the customer is already purchasing.

The archetypal example of the cross-selling technique is the McDonald’s cashier who asks, “Do you want fries with that?”

The additional item you’re selling is complementary to what they’ve already agreed to buy—not just any additional product. You’re helping the customer maximize the value they get from that purchase or improve the customer’s experience when using it.

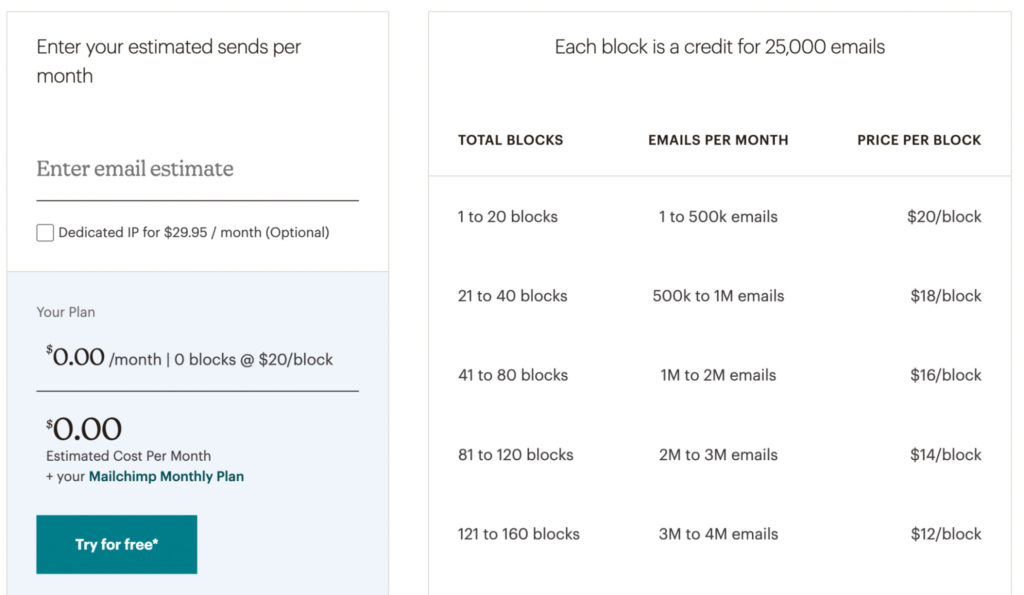

For instance, a sales rep at Mailchimp could cross-sell blocks of email marketing credits to a customer signing up for a Website package.

The email credits are a complementary item that benefits the buyer who will want to stay in touch with the leads they capture.

This cross-sell could take place at signup, or an account manager could reach out at a later point (having identified a cross-sell buying signal).

Where cross-selling goes wrong

The best cross-sells are enhancements, not requirements.

Apple provides a good example of each. New iPhones no longer ship with a power adapter or headphones.

You don’t need headphones to use your phone, making them complementary to the core product. So, headphones like Apple’s AirPods are a great upsell opportunity.

You can’t, however, use an iPhone without charging it.

The exclusion of a power adapter creates a cross-sell opportunity, but it’s a forced one and not a good example of a cross-selling strategy you should pursue.

There’s also a reason why you don’t see a pop up for the latest Apple Watch or MacBook on its iPhone checkout page: this would be a poor example of a cross-sell. These are not relevant products, and they may also be a good deal more than the customer was willing to spend (we’ll explore price anchoring in a moment).

Ensure cross-sell offers are highly-relevant to buyer motivations

Salespeople must ask: what drove this customer to purchase in the first place?

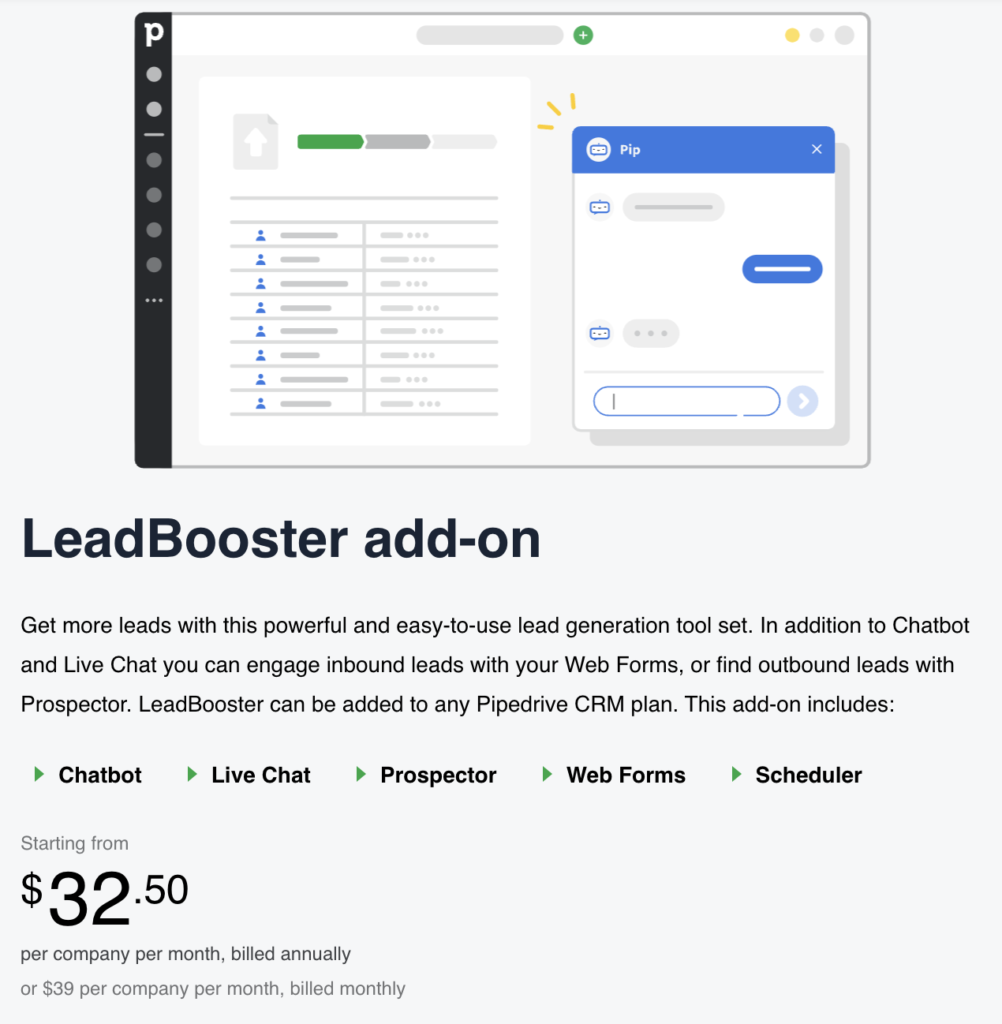

Take sales CRM Pipedrive.

A sales rep at Pipedrive might identify that their customer’s primary motivation for purchase was the need to grow revenue. They intend to use Pipedrive to build a demand funnel, monitor performance and identify areas for training.

Pipedrive’s LeadBooster add-on serves the same goal (driving revenue growth through lead generation), making it an appropriate product for cross-selling.

When opening a cross-sell conversation, ensure the additional product is not only relevant to the original purchase but serves the same goal.

Use price anchoring to drive cross-sell conversions

Cross-selling is most effective when the additional product or service is much lower in price than the initial purchase, taking advantage of a psychological effect known as price anchoring.

Price anchoring is all about how we perceive monetary values relatively.

Put simply, once we’ve already agreed to pay $200 for an item, considering an additional $20 to get more value out of the original product seems like a good choice.

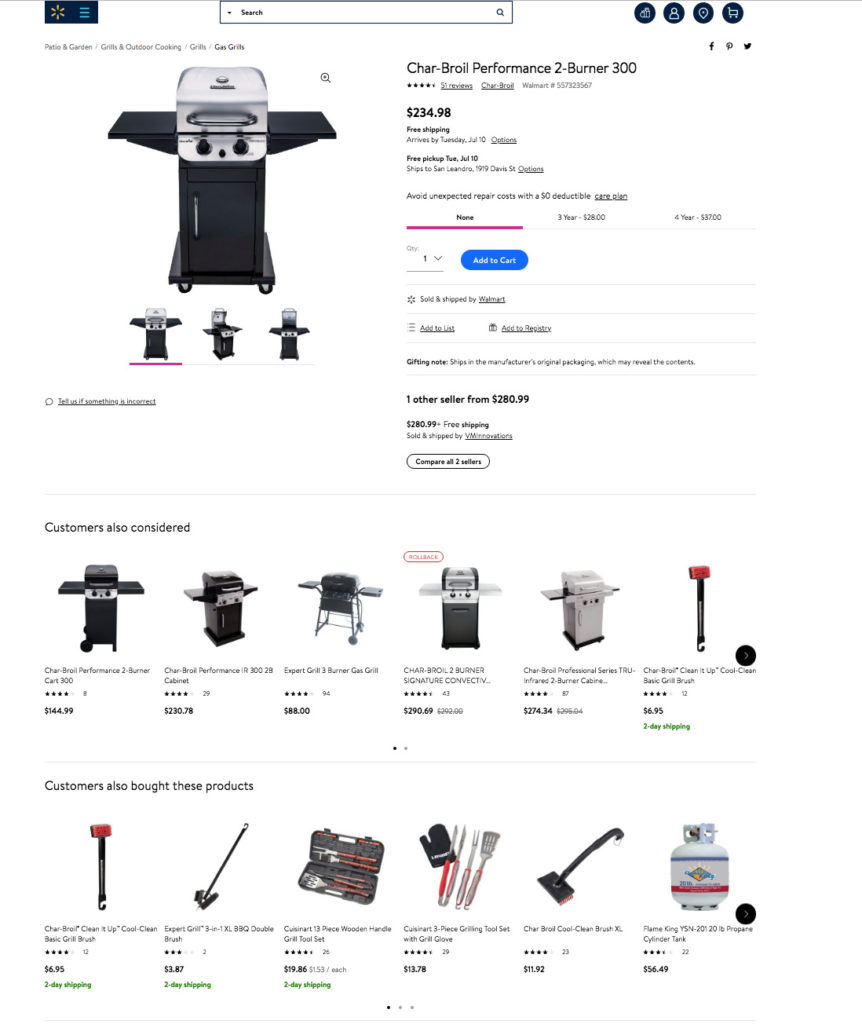

Retail and ecommerce businesses like Amazon and Walmart use this tactic regularly to sell products that are frequently bought together. Here Walmart links to additional product pages that customers “also considered” and “also bought.”

Having already agreed to purchase the $235 barbeque, complementary products like a $7 grill brush seem much more affordable.

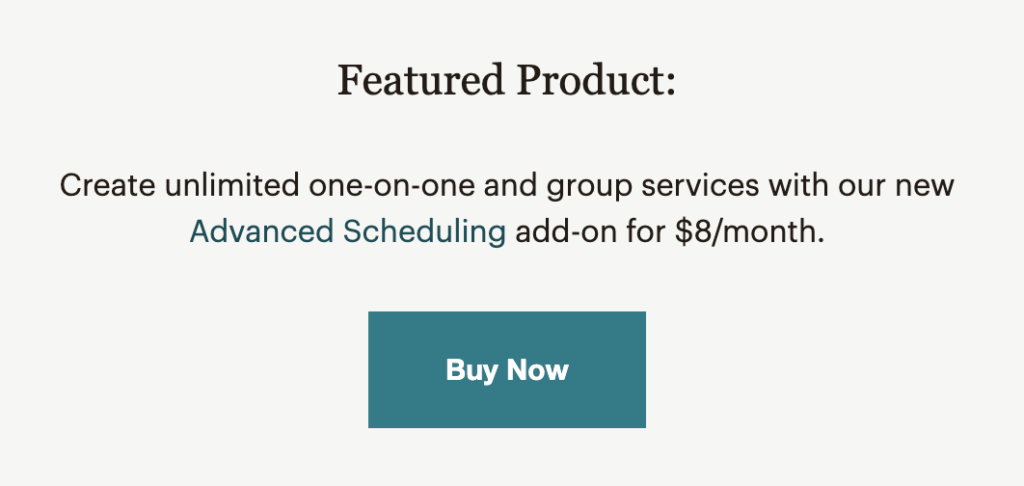

Consider Mailchimp’s Advanced Scheduling add-on.

At just $8 per month, it’s a relatively small additional cost compared with the Plus plan’s monthly cost of $29.

When cross-selling, aim for your additional product to cost no more than 20% and 30% of the original total, and choose items that enhance the value of the bigger ticket item.

Customize cross-sell offers based on customer usage and needs

The best examples of cross-selling are deeply contextual.

There is no point in Pipedrive sales agents trying to sell the LeadBooster product to every customer. Instead, they should look at product usage to identify opportunities.

For example, the agent could review account usage to determine if a customer is working on an outbound or inbound sales model (e.g., where are their new leads coming from?).

An account using an inbound model is far more likely to entertain a cross-sell discussion about their LeadBooster add-on.

The second question to answer here is about need: “Will this client truly benefit from the additional product?”

If the answer is yes, this would be a good cross-sell opportunity for the Pipedrive rep.

Incorporate cross-sell opportunities into customer review meetings

Like all sales, cross-selling is most effective when it doesn’t feel like a pitch.

If you call a customer three weeks into their subscription to say, “Hey, I’ve got this great product add-on I want to talk to you about,” it’s probably going to feel like a hard sell.

One effective method for making cross-sell attempts feel more natural and conversational is to incorporate them as part of your regularly scheduled customer review meetings.

To clarify, you shouldn’t schedule these meetings with the sole intent of opening a cross-sell conversation.

Customer review meetings should already be a part of your customer success program, fueling goal alignment and nurturing the brand-buyer relationship. These conversations can make for appropriate segways into cross-sell conversations.

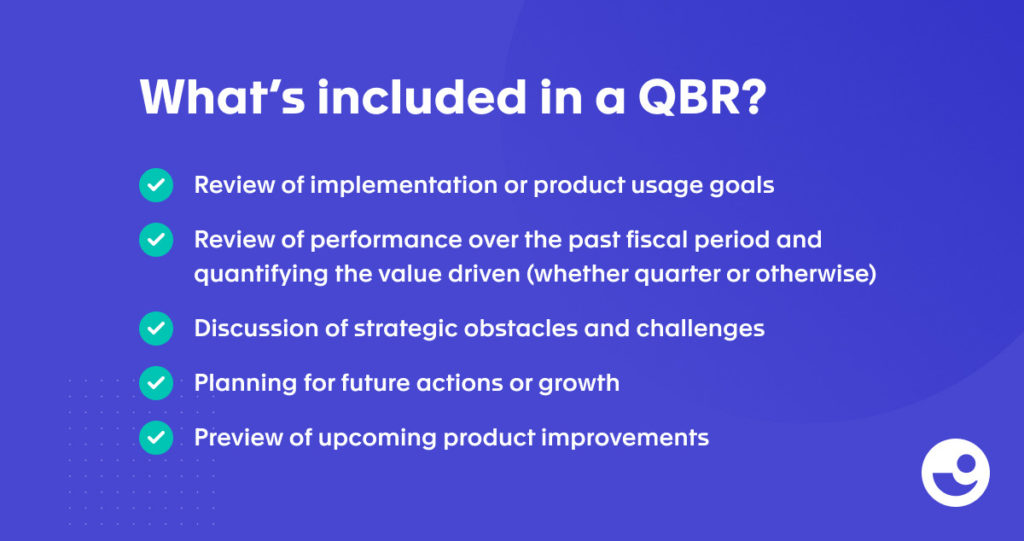

For instance, customer success suite Catalyst’s QBR (quarterly business review) agenda includes a discussion of strategic obstacles as well as plans for future growth.

These discussion points are ripe with cross-sell opportunities.

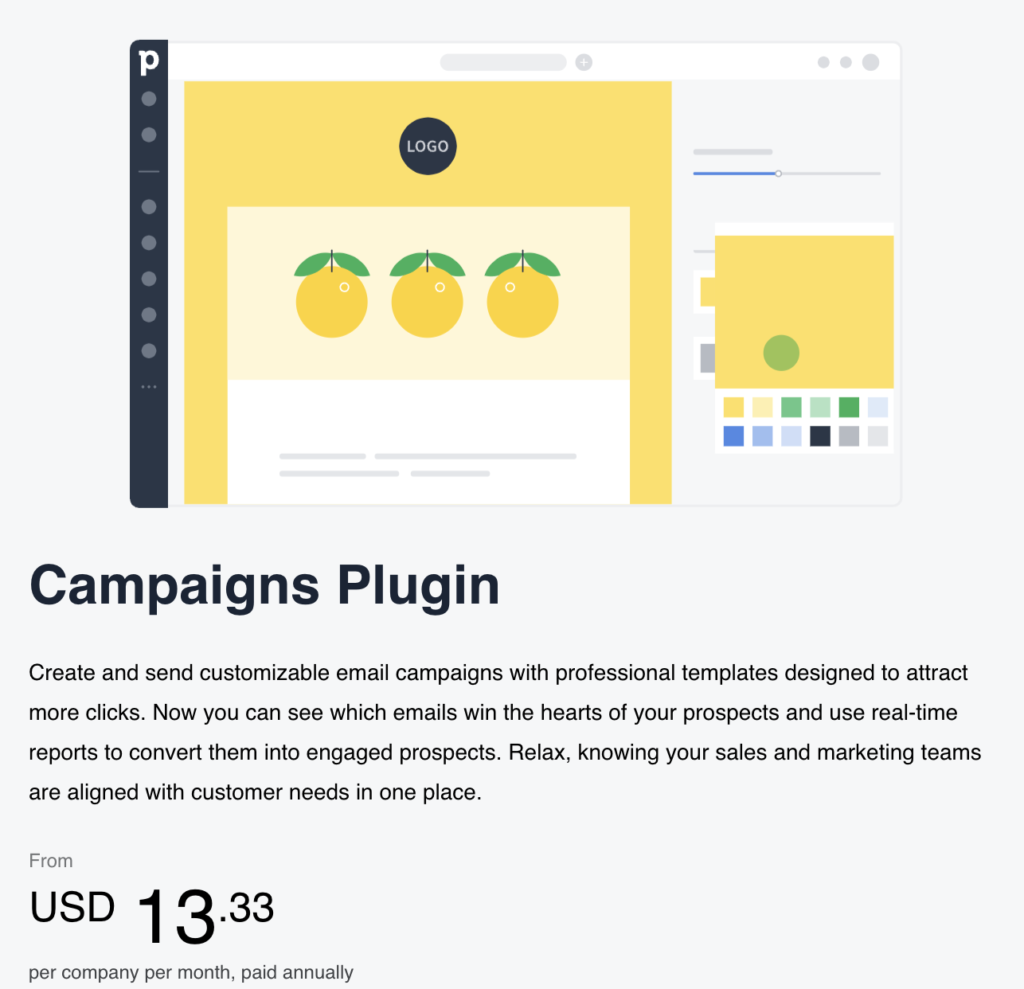

For example, say a Pipedrive customer is speaking to a rep on a QBR call, and they explain that one of their goals for the upcoming quarter is to improve their email lead nurturing. This signals to the agent that they’re a great opportunity for cross-selling the Campaigns Plugin.

When preparing for customer review meetings, be mindful of potential cross-sell opportunities, and be on the lookout for key phrases and need signals during that conversation.

Maximizing performance: What is upselling?

Upselling is the practice of convincing customers to purchase a higher-value product.

Where cross-selling looks to identify products that are complementary to the original purchase, upselling strategies look to swap out the original purchase for a higher-end item that presents greater value to the customer.

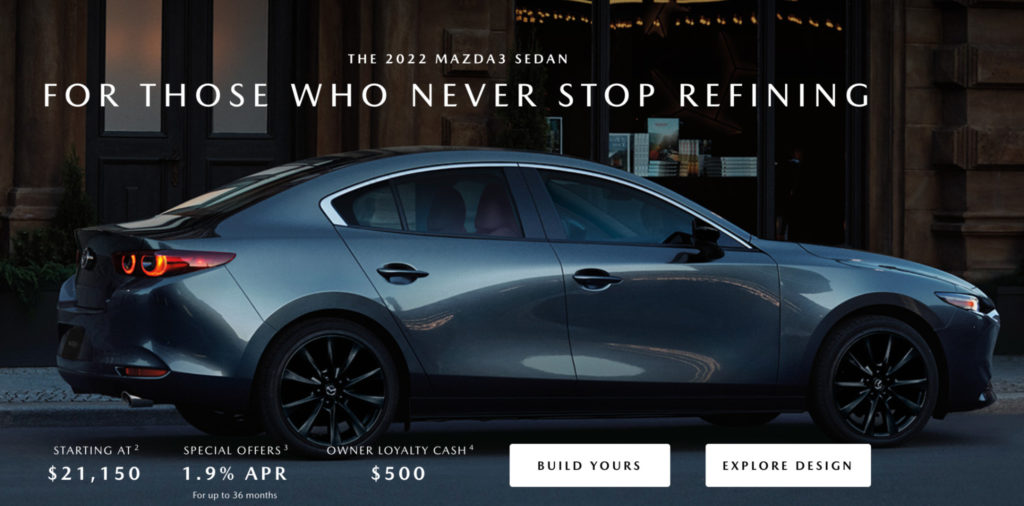

The archetypal upsell occurs in car showrooms.

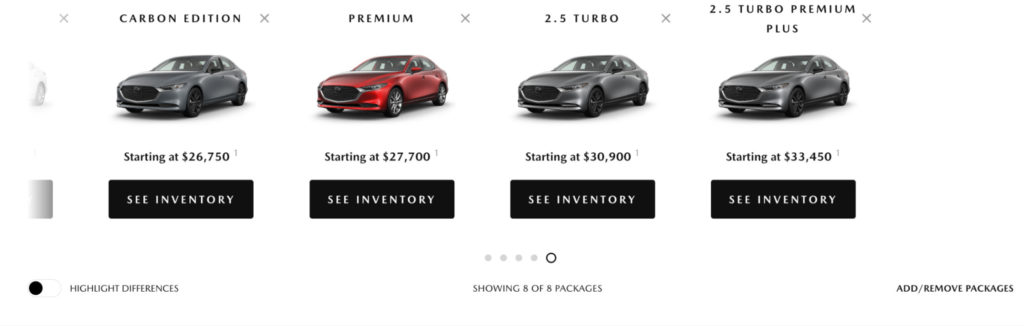

Take Mazda’s latest version of the Mazda3 sedan, advertised at a starting price of $21,150.

When customers head to the lot, one of the salesperson’s primary goals will be to upsell the buyer to a more luxurious package, of which there are eight.

The benefit to the company is obvious. If successful, a sales rep can turn a $21,000 sale into a $33,000 one, generating an additional 58% in revenue through a single sale.

It’s such a powerful channel for revenue growth that many SaaS companies bake upsell opportunities into their pricing model.

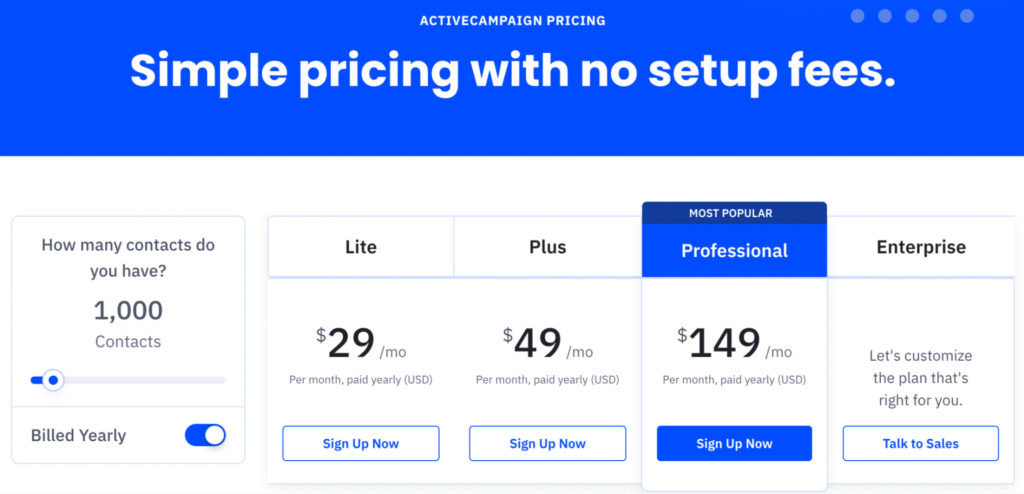

Take ActiveCampaign. Their pricing model attracts SMB and entry-level users to their Lite plan, baked into which is an upsell opportunity that could generate more than 5x revenue (if a customer upgrades from the Lite plan to the Professional tier).

Where upselling goes wrong

The biggest problem with most upsell attempts is a lack of personalization.

Sales reps simply spout some variation of, “Hey, do you want this version? It’s better.” They may back up this claim with some stats, feature walk-throughs, and social proof but ultimately fail to make a compelling case to that individual buyer.

Consider the buyer intent: they’ve already analyzed your pricing tiers and decided that the more expensive plans didn’t represent enough value for their current circumstances. You’ll need to counter their specific objections or appeal to more fitting benefits.

Upselling requires deep personalization

Upselling comes back to sales 101: understand the buyer’s needs, then communicate how your product solves them.

Many SaaS products today, however, are quite complex (particularly as you move toward the top pricing tiers). Understanding how your product benefits fit a client’s goals and operational needs can take some time.

For this reason, many sales reps find more success upselling further on in the relationship, rather than at the point of initial sale.

Consider a customer who has just signed up for ActiveCampaign’s Lite plan. They’ve never worked with an email marketing automation platform before, so the breadth of features offered by even the most basic plan might be overwhelming.

In addition, features like predictive sending, split automations, and contact scoring are likely out of scope for a company just getting started with email marketing.

A clued-in sales rep at ActiveCampaign would identify this, knowing that they’ll have a better shot at long-term customer retention (the real key to SaaS revenue growth) if they can:

- Get the customer on board now;

- Demonstrate product value in real life;

- Nurture the relationship through educational content and customer success initiatives.

Further down the track, the account manager may identify an important upsell opportunity signal: the customer has increased lead generation by 200% but is failing to effectively manage these opportunities. Translation: they need ActiveCampaign’s CRM features, available in the Plus plan.

To be most effective during upsell conversations, personalize offers based on customer needs and usage.

Leverage relevant customer success stories

Social proof plays a role in the upsell game, but only if it’s highly relevant to the specific customer you’re selling to.

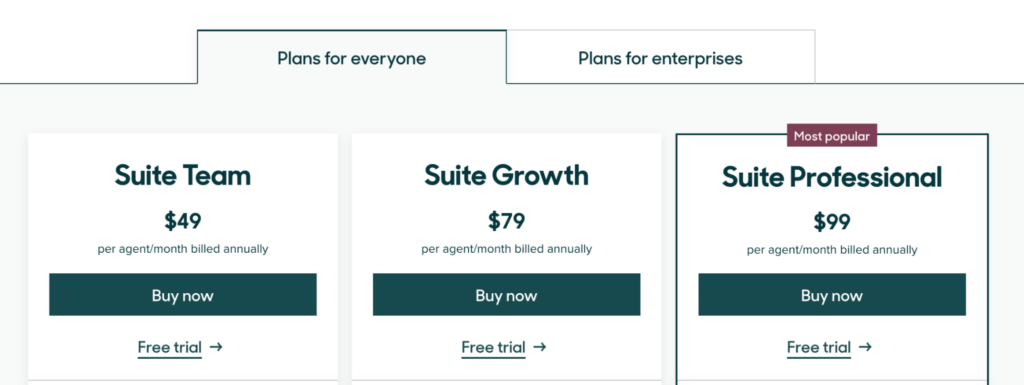

Take Zendesk, which offers three standard pricing tiers and an additional two aimed at enterprise-level companies.

Zendesk has built incredible upsell (and therefore revenue) potential into their pricing model. The difference between the cheapest and most expensive plans is $166 per agent. For an enterprise customer like Tesco, with 7,400 agents, that’s a little over $1.2m in upsell revenue.

To reap this potential benefit, Zendesk will need to leverage relevant social proof when upselling to other enterprise companies.

Success stories from the likes of Uber will help with big brand name clout, but these should be supplemented with industry-relevant stories:

Use social proof to bolster your upsell pitches, but only if those customer stories are deeply relevant to your customer’s industry, needs, and use cases.

Offer an extended free trial to help customers see value in-situ

Free trials are regularly used during the initial customer acquisition process, but they’re also a powerful sales technique for supporting an upsell.

Make your initial pitch based on identified customer needs, then put your money where your mouth is by offering an extended trial of the upgraded plan you’re promoting.

This can help build mental ownership thanks to a cognitive bias we all share called the endowment effect. If you’re successful at helping users adopt and embed the features included in the higher-tier plan, you’re more likely to raise your conversion rate.

What you need to know before deciding to cross-sell or upsell

Just because you can present a cross-sell or upsell opportunity doesn’t mean you should.

Get the timing wrong, and you’ll not only lower your chances of converting, but risk coming off as a pushy sales rep and ultimately alienating the customer.

You need enough customer data to personalize an offer

During initial sales conversations, the information you have on customer needs, motivations, and operational requirements is entirely based on what the prospect chooses to share with you.

As a salesperson, your ability to build rapport and ask high-quality explorative questions has a profound influence, but your intel on the customer is still largely based on conversation.

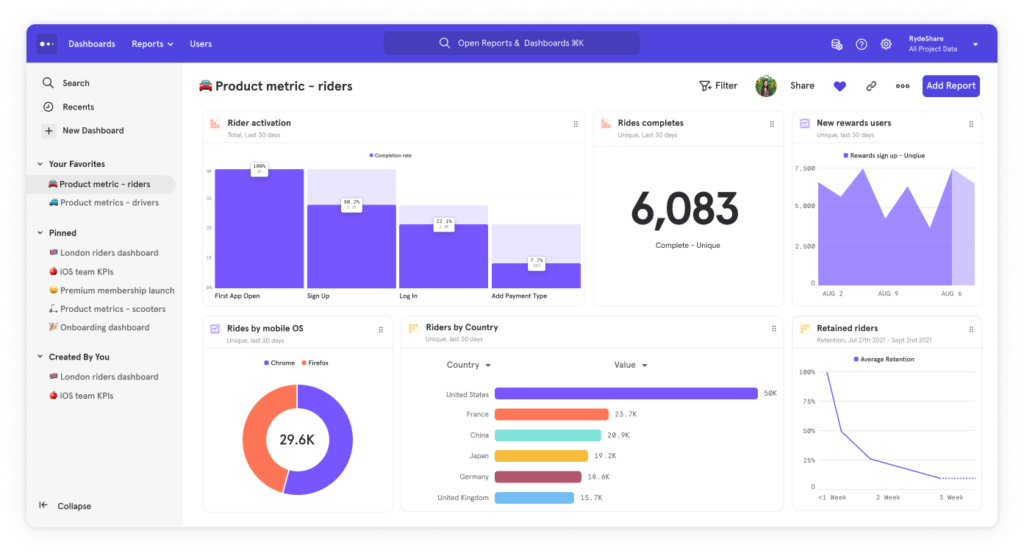

In SaaS, that all changes once they start using your product, sending a goldmine of data to interpret.

With product analytics platforms like Mixpanel, sales teams can dive deep into product usage and uncover upsell opportunities.

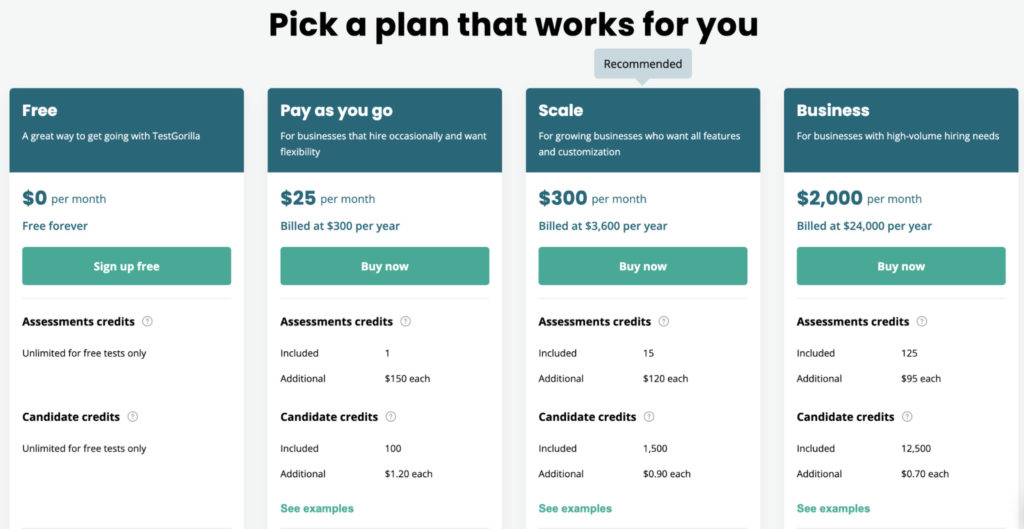

Take TestGorilla, a pre-employment screening and candidate testing platform. Their pricing model is based on assessment and candidate credits (i.e. it’s a usage-based pricing structure).

This pricing model makes upsell opportunity identification easy. If a customer on the “Pay as you go” plan purchases two or more additional assessment credits, their monthly cost exceeds what they’d pay if they upgraded to the Scale plan.

Here, TestGorilla can provide a personalized offer via email as soon as this customer purchases just one additional assessment credit. Its message could be something like:

“Hey, you just purchased an additional assessment credit, bringing your monthly bill to $175. Sounds like you’re growing fast! For just $125, we can upgrade you to the Scale plan, which will give you 15 monthly assessment credits and 15x more candidate credits.”

What you must be able to answer

Before you jump into a new upsell or cross-sell opportunity, ask yourself these three questions.

How will the customer benefit?

You must be able to communicate how the customer will benefit from the upgrade.

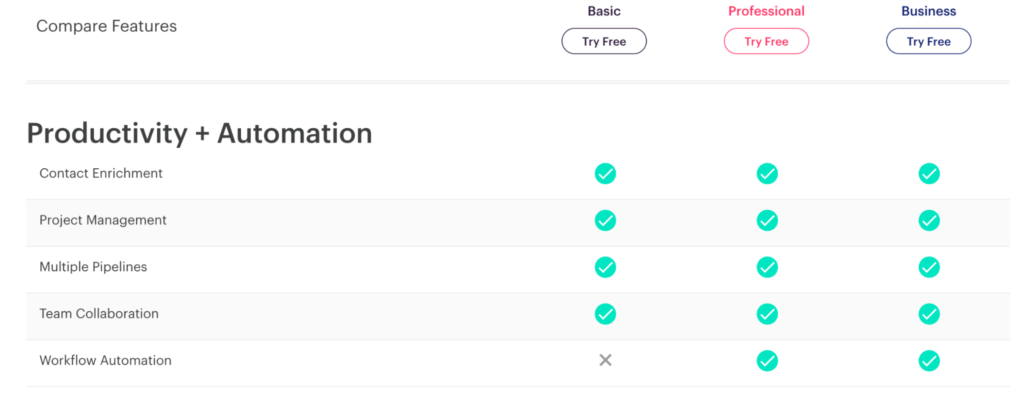

Don’t talk about features, talk about impacts. Sales CRM Copper is a good example of this:

To move a customer from the Basic plan to the Professional tier, you must describe exactly how workflow automation will benefit that customer.

It’s not enough to assume they understand what the impact of this feature is, or what it even means. But, if a sales rep can communicate in terms that relate to that specific customer’s usage, they’ll win.

For instance, its message could be:

“I’ve noticed that you’ve set your sales pipeline up so that after each action, be it a phone call, email, or SMS message, the sales agent moves the account card forward one pipeline stage.

With our workflow automation feature, we can automate that so the lead moves forward as soon as the phone call activity is checked off. It seems small, but when you’re dealing with hundreds of activities each day, this can add up to tens of hours saved each week which your team can reinvest into those selling activities that really move the needle.”

Is the customer willing to spend more?

This depends largely on the customer journey stage.

If they’re an early-stage company (i.e. pre-revenue), they might struggle to afford a higher-tier plan or product add-on. When this is the case, your best move is to help them get the most out of their current plan so they can drive revenue (or cut costs, depending on the space you occupy) and eventually have the financial ability to upgrade.

That said, in many cases, it’s not so much about the customer’s ability to afford the upgrade, but their willingness.

This will come down to your ability to demonstrate value. For example, if the higher-priced product costs $100 extra a month, but you can demonstrate how it will help the customer generate an additional $1000 a month in revenue, you’ll win.

Is our checkout process smooth?

The last thing you want to do is draw out the sales cycle right when a buyer is about to sign.

Advanced sales reps will make a decision early on: “Do I have an opportunity to cross-sell now, or will we have a better shot if we get them onboarded, demonstrate value, and leverage usage data to create a compelling offer?”

If you fail to make the checkout process smooth, you’ll risk losing not just the cross-sell but the entire sale.

Pre-sale vs. post-sale upselling and cross-selling

Opportunities to upsell or cross-sell exist both at the point of initial sale (i.e. to a new customer) and at various points throughout the customer lifecycle (i.e. to existing customers).

There is no “one size fits all” approach here.

The decision to engage in a pre-sale or post-sale upsell or cross-sell depends on two key factors:

- Your industry;

- Each specific customer.

Online stores, for instance, are almost always going to be more likely to cross-sell products if they do so pre-sale (i.e. on the checkout page).

Take Converse. An upsell from a canvas shoe to a leather shoe can only take place pre-sale. It’s impractical to try and upsell after they’ve already purchased and worn the item.

Cross-sells in ecommerce can take place post-sale, but it’s still an awkward proposition.

Adding a $7 can of suede protector to your shoe purchase is a simple proposition; being asked to make a second purchase a week later (and having to pay an additional shipping fee) is unlikely to motivate consumers.

In the SaaS and B2B world, the opportunity to engage in post-sale upsell and cross-sell conversations makes more sense.

Part of this comes down to the fact that there is no physical product, so upgrading at a later point is a logical proposition. Plus, reps can take advantage of product adoption and usage analytics, which can trigger buying signals that kick off cross-sell and upsell conversations.

There is, of course, an element of salesperson discretion here.

By and large, reps should have the opportunity to cross-sell or upsell on the spot, if they see burning customer needs that they can leverage.

Similarly, they may also identify that a particular customer is standoffish, hesitant, or unconvinced that the product is right for them, despite proceeding with a subscription.

In this case, salespeople should not push the sale (and risk losing the customer altogether). Make a note for future upsell or cross-sell opportunities that the customer support team can nurture.

Conclusion

Upselling and cross-selling are sales tactics that, when used correctly, can be instrumental for long-term revenue growth, particularly in subscription businesses.

Successful cross-selling is all about relevance, customization, and leveraging price anchoring to make the additional cost seem minimal. Timing and information are everything for upselling, so many sales reps in B2B SaaS environments find it easier to upsell further in the relationship.

Upselling in the ecommerce world is a very different game. Master the skills in our guide, How To Boost Ecommerce Sales With Upselling.